My First Steps into Stock Market Investing

My investing journey began in February 2025. To be honest, I didn’t dive deeply into the subject. I chose my stocks rather quickly, relying on a handful of articles and analyst forecasts from popular online platforms. I wouldn’t call the results catastrophic, but I also wouldn’t call my start successful.

My portfolio is split into two parts — a TFSA (Tax-Free Savings Account) and an RRSP (Registered Retirement Savings Plan). These are special Canadian accounts that help reduce taxes, but both come with annual contribution limits. The TFSA is great because any growth or profit inside the account isn’t taxed. The RRSP, on the other hand, was created to help people save for retirement. You can technically withdraw money from it at any time, but unless you’ve reached retirement age, the amount you take out will be taxed. I’ll go into more detail about these accounts in a later post.

Apart from my lack of experience in investing and the stock market, there were other reasons for my rocky start. First, I got caught in the fall of tech stocks, which was quite unpleasant. But I already understood that losses are inevitable when buying stocks. Since my goal is long-term investing, I was prepared for that. Later, Trump’s “performance” with his tariffs triggered panic and a market downturn. Some of my stocks fell by more than 60%. Fortunately, most of them have already recovered, and my portfolio is now showing fairly good results.

My first portfolio was a TFSA, and after seven months of investing, it still hadn’t turned a profit. At one point, it showed a little over 1% gain, but then it fell back into the red. It has now been holding steady in the range of -2% to 0% for quite some time. The reason is simple — instead of doing any real analysis of the companies, I just looked at charts showing an upward trend and analyst forecasts. With my lack of experience and knowledge, I believed the stock prices would continue to rise. Even though I already understood that investing in certain stocks was risky, I still invested small amounts. So, despite having a few companies in my portfolio that dropped 30–40%, my overall portfolio is showing a decent profit. There was, however, a period when it sank nearly 20%.

On the other hand, risky stocks with high volatility also offer the chance for big profits. For example, the stock of Innoviz Technologies Ltd dropped by more than 60%, only to rise over 80% afterward. It’s worth noting that shares of today’s tech giants — like Amazon, Google, and Microsoft — also once traded for just a few dollars, and those who kept believing in them made millions. Of course, not everyone has the patience to watch their stock prices plummet while their capital melts before their eyes. At the same time, many companies went bankrupt, never returning the invested funds to their investors.

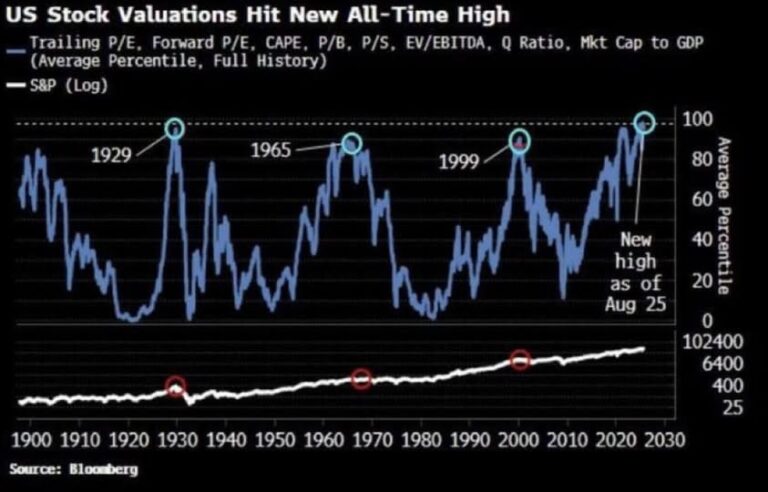

You need to be fully aware of the risks and keep your portfolio balanced. Only you can decide how much risk you’re willing to take as an investor when choosing which stocks to buy. Still, it’s important to remember that there will always be market downturns, and they are impossible to predict. If you’re not prepared for this, it’s unlikely you can become a long-term investor — patience is essential. As Warren Buffett said, “The stock market is a device for transferring money from the impatient to the patient.” What this means is that after every decline, the market eventually recovers and continues to grow. In the meantime, the “impatient” sell their stocks and lock in losses, while the “patient” buy (or add more) during the downturn at more attractive prices. They often call it a “sale.”

Here’s a quick look at the stocks I currently hold in my portfolio:

TFSA

| Company/Ticker | Exchange | Quantity |

| Allot Ltd (ALLT) | NASDAQ | 40 |

| Amazon.com Inc (AMZN) | NASDAQ | 1 |

| AppLovin Corp (APP) | NASDAQ | 0.7903 |

| BigBear.ai Holdings Inc (BBAI) | NYSE | 10.9162 |

| DoubleVerify Holdings Inc (DV) | NYSE | 2 |

| Innoviz Technologies Inc (INVZ) | NASDAQ | 230.6762 |

| IonQ Inc (IONQ) | NYSE | 2.445 |

| Lilly(Eli) & Co (LLY) | NYSE | 0.5459 |

| Meta Platforms Inc (META) | NASDAQ | 0.278 |

| Merck & Co Inc (MRK) | NYSE | 2.3185 |

| SuperCom Ltd (SPCB) | NASDAQ | 7.2037 |

| Sensus Healthcare Inc (SRTS) | NASDAQ | 16.2117 |

| Taiwan Semiconductor Manufacturing (TSM) | NYSE | 1.0026 |

| UnitedHealth Group Inc (UNH) | NYSE | 1 |

RRSP

| Company/Ticker | Exchange | Quantity |

| Agnico Eagle Mine Limited (AEM) | TSX | 4.0186 |

| Advanced Micro Devices Inc (AMD) | NASDAQ | 6 |

| Bird Construction Inc (BDT) | TSX | 23.3209 |

| Bravo Mining Corp (BRVO) | TSX-V | 3.6532 |

| Celestica Inc (CLS) | TSX | 10 |

| Cisco Systems, Inc (CSCO) | NASDAQ | 4.2947 |

| Dollarama Inc (DOL) | TSX | 8.0095 |

| EOG Resources, Inc (EOG) | NYSE | 2.155 |

| GoEasy Limited (GSY) | TSX | 2.4464 |

| JPMorgan Nasdaq Equity Premium Income ETF (JPEQ) | NASDAQ | 5.0332 |

| Orla Mining Ltd (OLA) | TSX | 40 |

| Regions Financial Corp (RF) | NYSE | 11.6771 |

| Taiwan Semiconductor Manufacturing (TSM) | NYSE | 3.0078 |

| Vanguard S&P500 Index ETF (VFV) | TSX | 2.6086 |

| Vitalhub Corp (VHI) | TSX | 51 |

Some of the stocks in my portfolio were bought early on, back when I had little experience, as I mentioned above. Looking back, I can see that buying SuperCom Ltd (SPCB) and Sensus Healthcare Inc (SRTS) was a mistake. To be honest, I still know very little about these companies. SPCB even went into the green at one point, and it might actually be an interesting company — I’ll need to research it more thoroughly. As for BigBear.ai Holdings Inc (BBAI), I’m not sure. Maybe it will still “take off.”

I also sold some stocks and ETFs from my portfolio: Alimentation Couche-Tard Inc (ATD), Neurocrine Biosciences Inc (NBIX), Vanguard FTSE Canadian High Dividend Yield Index ETF (VDY), Ouster Inc (OUST), TC Energy Corporation (TRP), Stag Industrial Inc (STAG), VanEck Semiconductor ETF (SMH), AbbVie Inc (ABBV), and Strategy Inc (MSTR). All of them were sold either at a profit or around break-even.

I also bought UnitedHealth Group Inc on a whim. I don’t remember why I made that decision, but it was a mistake — I bought the stock too early. I hope its price continues to recover.