Portfolio Reveal: My Real Investing Results for Feb–Aug 2025

In the previous post, I showed which company stocks I have in my portfolio. In this post, I’ll reveal my entire investing portfolio along with the real results of my investments so far. I plan to publish such result updates regularly, most likely every month. This post will be the starting point, covering my results for the entire period of my investing journey.

My First 7 Months of Investing

I bought my very first stocks in February 2025. That means my portfolio is now almost seven months old. Over this time, I’ve invested a total of 12,393 CAD. Here are the results from February through August 2025:

- Starting value: 12,393 CAD (≈ 9,012 USD)

- Ending value: 15,700.41 CAD (≈ 11,417 USD)

- Total return: +26.69% (+3,307 CAD / +2,405 USD)

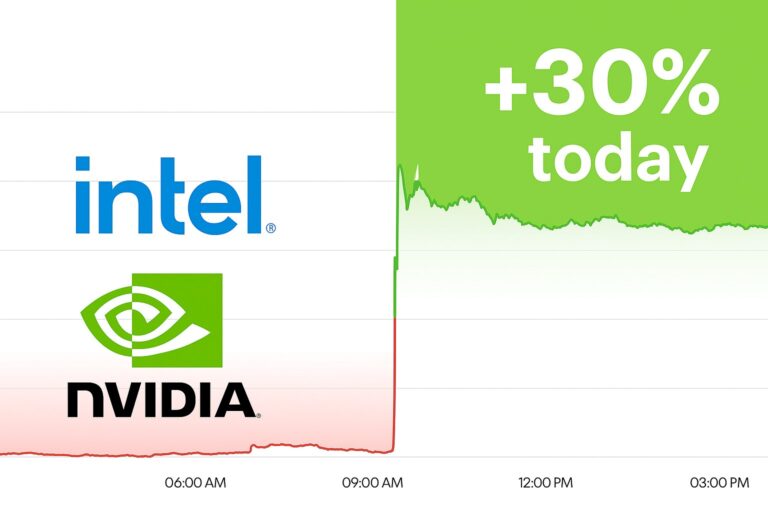

- At one point, the gain was even above 30%.

💵 Dividends received so far: 85.05 CAD

Here’s what my TFSA portfolio looks like right now:

| Ticker | Company / ETF | Total value | Allocation % | Gain/Loss % | Notes |

| INVZ | Innoviz Technologies Ltd | 385.38 USD | 13.03% | 52.12% | Long-Term/Speculative |

| APP | AppLovin Corp | 377.13 USD | 12.75% | 25.39% | Long-Term/Speculative |

| TSM | Taiwan Semiconductor Manufacturing | 231.7 USD | 7.84% | 26.93% | Long-Tem |

| AMZN | Amazon.com Inc | 228.79 USD | 7.74% | 3.24% | Long-Term |

| META | Meta Platforms Inc | 205.03 USD | 6.93% | 2.73% | Long-Term |

| IONQ | IonQ Inc | 104.4 USD | 3.53% | 4.08% | Long-Term/Speculative |

| DV | DoubleVerify Holdings Inc | 32.92 USD | 1.11% | 10.04% | Long-Term |

| MRK | Merck & Co Inc | 195.06 USD | 6.60% | -3.74% | Long-Term |

| UNH | UnitedHealth Group Inc | 308.9 USD | 10.45% | -4.07% | Long-Term/Speculative |

| SPCB | SuperCom Ltd | 66.92 USD | 2.26% | -25.55% | Thinking |

| ALLT | Allot Ltd | 310.00 USD | 10.48% | -8.82% | Long-Term/Speculative |

| SRTS | Sensus Healthcare Inc | 55.61 USD | 1.88% | -40.75% | Thinking |

| BBAI | BigBear.ai Inc | 55.24 USD | 1.87% | -41.97% | Thinking |

| LLY | Lilly (Eli) & Co | 399.74 USD | 13.52% | -13.85% | Long-Term |

My RRSP portfolio currently includes the following stocks:

| Ticker | Company / ETF | Total value | Allocation % | Gain/Loss % | Notes |

| CLS | Celestica Inc | 2675.00 USD | 23.08% | 191.39% | Long-Term |

| AMD | Advanced Micro Devices Inc | 973.98 USD | 11.55% | 63.79% | Long-Term |

| DOL | Dollarama Inc | 1499.86 CAD | 12.94% | 18.73% | Long-Term |

| AEM | Agnico Eagle Mines Limited | 795.72 CAD | 6.87% | 37.39% | Long-Term |

| TSM | Taiwan Semiconductor Manufacturing | 695.10 USD | 8.24% | 28.65% | Long-Term |

| VHI | VitalHub Corp | 642.6 CAD | 5.54% | 31.12% | Long-Term |

| GSY | GoEasy Limited | 521.18 CAD | 4.50% | 38.76% | Long-Term |

| OLA | Orla Mining Ltd | 606.4 CAD | 5.23% | 18.62% | Long-Term/Speculative |

| RF | Regions Financial Corp | 322.03 USD | 3.82% | 13.27% | Long-Term/Dividends |

| CSCO | Cisco Systems Inc | 296.55 USD | 3.52% | 6.08% | Long-Term |

| BDT | Bird Construction Inc | 527.29 CAD | 4.55% | 2.20% | Long-Term |

| VFV | Vanguard S&P 500 Index ETF | 410.75 CAD | 3.54% | 2.18% | Long-Term |

| BRVO | Bravo Mining Corp | 11.11 CAD | 0.10% | 10.95% | Speculative |

| EOG | EOG Resources Inc | 269.38 USD | 3.19% | -3.35% | Long-Term/Dividends |

| JEPQ | JPMorgan Nasdaq Equity Prem Income ETF | 280.60 USD | 3.33% | -3.87% | Long-Term/Dividends |

Going forward, I’ll keep updating you on changes in my portfolio — what I’ve bought or sold. Unfortunately, I wasn’t able to add to my portfolio for a couple of months. Summer turned out to be busy and expensive: camping trips, a planned vacation, car maintenance, and some unexpected expenses. On top of that, food prices have noticeably increased. I hope the situation stabilizes in the coming months.

The best-performing company in my portfolio during this period was Celestica Inc (CLS). At the time of writing, it has grown +191.39%, with a peak of +218%.

The worst-performing company was BigBear.ai Inc, down -41.97%.

What have I learned during these months of investing? You need to be cautious with lesser-known companies, like SRTS and SPCB. The stock price can change very quickly, and sometimes a seemingly minor piece of news can act as a “catalyst.” Even if a quarterly report looks great, investors may still find some negative signal that can trigger a sharp drop in the stock price.

Plans for next month: I’ll continue learning, explore new interesting stocks, and take a closer look at the ones I already hold. I also want to decide what to add to my portfolio and what might be better to sell.

This concludes my report for the end of August 2025. My portfolio has gone up and down, but that’s exactly what helps me learn new lessons in investing. I’ll continue sharing my results in the stock market so you can follow my progress. I hope this will also help other beginner investors.