Terra Innovatum (GSRT/NKLR): Nuclear Revolution or Risky Bet?

🚀 What is Terra Innovatum?

Terra Innovatum is a US-based startup developing innovative micro-nuclear reactors called SOLO™. The company plans to go public through a merger with SPAC (Special Purpose Acquisition Company) GSR III Acquisition Corp, currently trading under ticker GSRT on Nasdaq.

SPAC — a publicly traded shell company created specifically to acquire a private business and take it public.

After the deal closes (expected in H2 2025), the company will trade under the new ticker NKLR.

📊 Key Deal Metrics

- Merger valuation: $475M

- Expected proceeds: up to $230M

- Current GSRT price: $10.04 (near 52-week high)

- Additional funding: $37.5M (raised in 2025)

🔬 SOLO Technology: What’s Under the Hood?

Micro Modular Reactors (MMR) represent a new generation of nuclear facilities that are significantly smaller than traditional nuclear power plants, yet more flexible and safer.

SOLO Reactor Specifications:

- Power output: 1-4 MW electrical per module

- Fuel flexibility: operates on both LEU+ and HALEU fuel

- Scalability: from 1 MW to 1 GW

- Portability: compact design for various applications

LEU+/HALEU — types of enriched uranium with different concentration levels of U-235 isotope.

📈 Current Development Status

✅ 2025 Achievements:

- Active collaboration with NRC (Nuclear Regulatory Commission)

- Regulatory Engagement Plan submitted in January

- Safety Evaluation process initiated

⏰ Stated Timeline:

- End of 2025: NRC review completion

- April 2026: Safety Evaluation release

- 2028: Commercial deployment begins

NRC (Nuclear Regulatory Commission) — US federal agency that regulates nuclear energy use.

💡 My Take: The Nuclear Energy Trend

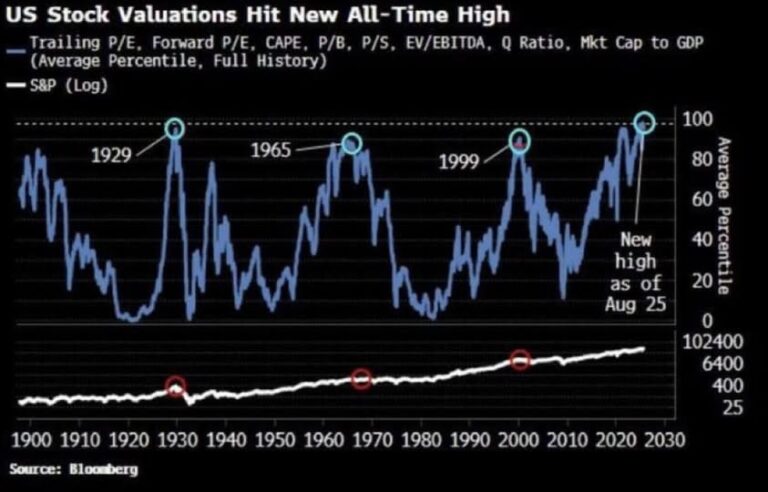

Currently, all nuclear energy-related stocks are experiencing a real boom. Investors are actively seeking alternatives to traditional energy sources, especially in the context of climate change and growing demand for “clean” energy. Micro-nuclear technologies look particularly attractive due to their flexibility and potentially faster deployment.

But it’s crucial to understand: this is still an early-stage startup. Real product commercialization is still far away — minimum 3-4 years under the best-case scenario.

⚖️ Risk-Reward Analysis

🟢 Opportunities:

- Industry trend: growing interest in nuclear energy

- Government support: US government actively supports SMR development

- First-to-market potential: could become leader in new niche

- Short-term speculation: hype around nuclear technologies

🔴 Risks:

- Regulatory delays: licensing could take years longer

- Technical challenges: micro-reactors are relatively new technology

- Competition: many companies working on similar solutions

- Capital requirements: will need significant additional investment

🎯 Investment Strategy

For speculative investors: opportunity to profit from short-term growth in nuclear sector stocks. Price around $10 per share looks like a reasonable entry point.

For long-term investors: worth waiting for more clarity on technical progress and regulatory approval. Consider this a high-risk, high-reward bet.

Recommended position: no more than 2-5% of portfolio due to high volatility.

📋 Bottom Line

Terra Innovatum presents an interesting opportunity to invest in the future of energy, but with significant risks. The company shows solid technical progress, has sufficient funding for the current stage, but commercialization is still years away.

Investment suitable for experienced traders ready for high volatility and potential losses in exchange for potentially high returns.

Important Disclaimer

- This is NOT financial advice.

- These are personal investment ideas based on fundamental analysis.

- Always do your own research.

- Never invest more than you can afford to lose.

Read in Ukrainian: “Terra Innovatum (GSRT/NKLR): Революція в мікро-ядерній енергетиці чи ризикована ставка?“