Investment Report for October-November 2025: My Results and Market Analysis

Reading time: ~8 minutes

📈 Key Performance Metrics (October-November)

Total Portfolio Return: +11.8% (over 2 months)

Return vs S&P 500: +6.5%

YTD Return: 57.55%

Total Portfolio Value: $19,525.79

Realized Profit/Loss: +$7,119.38

Quick Overview

Two months without reports – and there’s a reason for that! (September report) I spent October on vacation in Costa Rica 🌴, so I skipped the October report. But the portfolio didn’t rest and went through a real rollercoaster: October was positive, November brought a significant correction, but by month’s end, almost everything recovered. Bottom line: +12% over two months.

Key Events of the Period:

- Continued tech stock rally (October)

- November correction – portfolio lost 8-10% at the peak of the decline

- Rapid recovery – by month’s end, almost back to previous levels

- Fear & Greed Index remains at low levels – market in fear mode

- CLS reached incredible +423% since initial investment

- New position HOWL appeared (unsuccessful)

- Some speculative positions showed weakness

🎯 Top Positions of the Period

🟢 Absolute Growth Leaders

1. Celestica Inc ($CLS) – 🏆 PORTFOLIO CHAMPION

- End of September: $3,424.70 CAD (+273%)

- End of November: $4,801.10 CAD (+423%)

- Change over 2 months: +40.2%

- My position: 24.35% of RRSP portfolio

- Comment: Absolute star! Growth since initial investment exceeded 420%! When I started investing, I couldn’t even imagine something like this.🚀

2. AMD (Advanced Micro Devices) – +34.2%

- End of September: $964.38 USD (+62.17%)

- End of November: $1,307.16 USD (+119.82%)

- Change over 2 months: +35.5%

- My position: 6.63% of RRSP portfolio

- Comment: Semiconductors continue strong growth

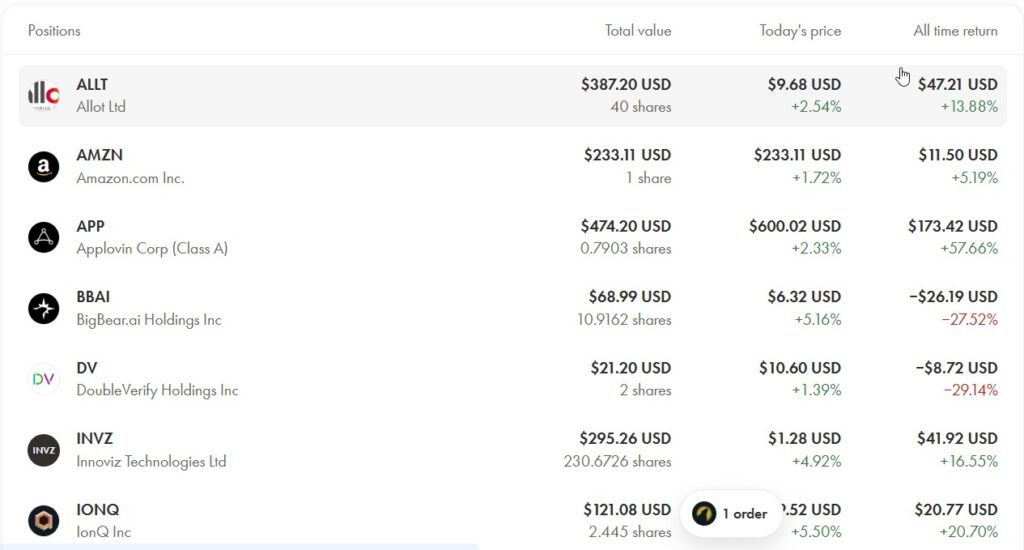

3. AppLovin Corp ($APP) – +5.8%

- End of September: $564.53 USD (+87.69%)

- End of November: $474.20 USD (+57.66%)

- Change over 2 months: -16.0%

- My position: 12.90% of TFSA portfolio

- Comment: Correction after S&P 500 inclusion, but still solidly in the green

🟢 Other Strong Performers

4. AEM (Agnico Eagle Mines) – +23.5%

- Growth from $944.44 CAD to $982.28 CAD

- All time return: +68.95%

5. TSM (Taiwan Semiconductor) – RRSP – +5.1%

- Growth from $836.20 USD to $879.45 USD

- All time return: +62.20%

6. INVZ (Innoviz Technologies) – -34.0%

- Drop from $447.50 USD to $295.26 USD

- All time return: +16.55% (was +76.64%)

- Comment: Significant correction of speculative position

🔴 Period’s Underperformers

1. HOWL (Werewolf Therapeutics) – -51.49% ⚠️⚠️

- New position: 22 shares at $0.9991 USD

- All time return: -51.49%

- Status: Worst investment in portfolio

- Comment: Biotech speculation didn’t pan out, sharp decline

2. GSY (GoEasy Limited) – -8.84%

- Drop from $424.13 CAD to $345.63 CAD

- Loss of $78.50 CAD

3. BBAI (BigBear.ai Holdings) – -27.52%

- Drop from $70.63 USD to $68.99 USD

- Continues struggling after August crash

4. DV (DoubleVerify Holdings) – -29.14%

- Continues decline (was -21.92%)

- Weakest position among more stable companies

💼 New Investments and Portfolio Changes

New Purchases

$HOWL (Werewolf Therapeutics Inc) – 22 shares at ~$0.9991 USD

- Investment thesis: Biotechnology company, speculative position

- Result: -51.49% 😔

- Lesson: High risk = high losses. Biotech requires much more thorough analysis

Sales

No sales over the two months.

Position Adjustments

- DFLI: Remains in portfolio, awaiting developments

- Most positions remained unchanged

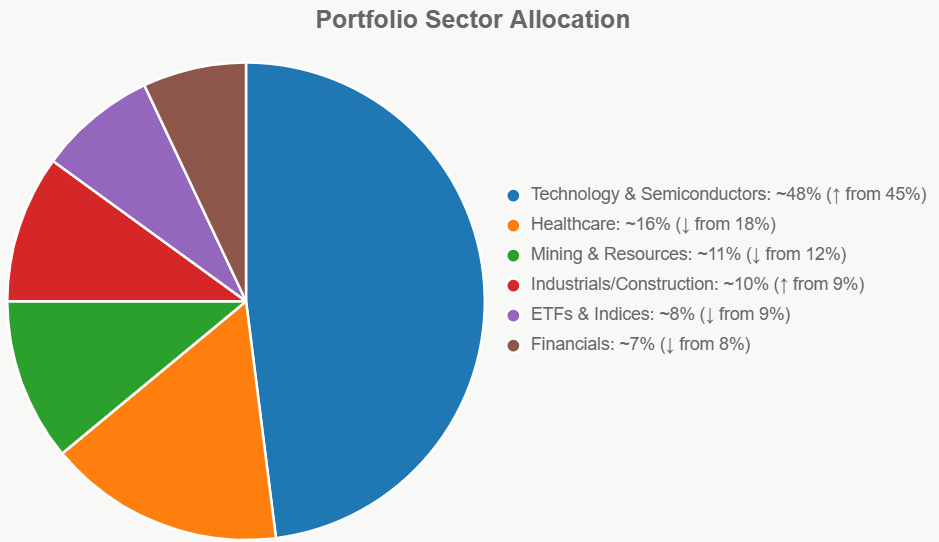

📊 Portfolio Sector Allocation

💻 Technology & Semiconductors: ~48% (↑ from 45%)

💊 Healthcare: ~16% (↓ from 18%)

⛏️ Mining & Resources: ~11% (↓ from 12%)

🏗️ Industrials/Construction: ~10% (↑ from 9%)

📈 ETFs & Indices: ~8% (↓ from 9%)

💰 Financials: ~7% (↓ from 8%)

Changes: Technology percentage increased due to strong growth of AMD and CLS.

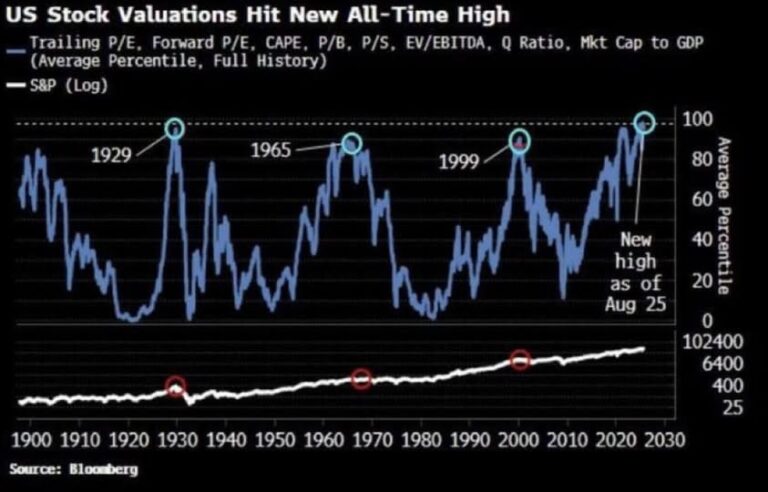

🌍 What Influenced the Market in October-November

Macroeconomic Factors

- Continuation of rate cut cycle – markets responded positively to accommodative monetary policy

- November correction – uncertainty about the pace of rate cuts triggered selloffs

- Fear & Greed Index – in the “Fear” zone, which historically signals buying opportunities

- Q3 earnings season – tech companies showed strong results

- Geopolitical tensions – some impact on volatility

November Market Dynamics

What Happened:

- Mid-November brought a sharp correction 📉

- My portfolio lost 8-10% at the peak of the decline

- Tech sector suffered the most

- By month’s end – almost complete recovery 📈

Why It Matters:

- Reminder of market volatility

- Portfolio stress test

- Opportunity to buy at lower prices (if cash available)

Corporate News

- Celestica continued to impress – each quarter exceeds expectations

- AMD benefited from AI boom – demand for AI chips supports growth

- AppLovin correction – natural correction after sharp rise

- Biotech under pressure – HOWL and other small biotech companies suffering

📝 Lessons from Two Months

What Worked Well ✅

1. Concentration in quality companies

- CLS and AMD continue to demonstrate strength

- Large positions in the right companies = foundation of success

2. Patience with best positions

- Holding CLS since February – result +423%

- Didn’t sell through waves of volatility

- Didn’t panic during November correction – and it paid off ✅

3. Diversification between accounts

- TFSA account more speculative

- RRSP more stable and conservative

4. Didn’t sell during the drop

- November showed that holding positions matters more than emotions

- Those who sold at the bottom – missed the recovery

What Can Be Improved 📚

1. HOWL – biggest mistake of the period

- -51.49% immediately after purchase

- Insufficient research before investment

- Biotech requires significantly more expertise

2. Too many positions

- 28 different stocks/ETFs – hard to follow all

- Better to have 15-20 quality positions than 28 of varying quality

3. Speculative positions

- INVZ, BBAI, SPCB, SRTS, HOWL – all showing weakness

- May need to reconsider approach to speculations

Key Takeaways 💡

1. Quality matters more than quantity

- 10% in CLS generated more profit than 5 small speculations combined

2. Not all sectors are equal

- Tech/AI = strong trend

- Biotech = requires deep expertise

3. Rebalancing necessary

- CLS already 24% of RRSP portfolio – perhaps too much?

- Need to think about taking some profits

4. Volatility is normal

- November correction of -8-10% was scary in the moment

- But recovery came quickly

- Fear & Greed Index in fear zone = opportunities for patient investors

5. Emotions are the biggest enemy

- During the drop, wanted to sell

- But logic prevailed over emotions

- Result: almost complete recovery

🔮 Plans for December

Critical Decisions 🎯

1. What to do with HOWL?

- Loss of 50%+ immediately

- Options: sell and realize loss, or wait for recovery?

- Decision: Will monitor for another month

2. CLS – take profits?

- +423% – phenomenal result

- Position already 24% of portfolio

- Decision: Will consider selling 30-40% of position for rebalancing

3. Speculative positions

- Continue holding BBAI, SRTS, SPCB?

- All showing weakness

What I’m Watching 👀

Energy Sector:

- AI needs energy – looking for interesting companies

- Possible candidates: nuclear energy, renewables

December Reports:

- Monitoring reports from main positions

- Tax loss selling season – may see good prices

Strategic Goals 🎯

1. Portfolio Rebalancing

- Reduce number of positions from 28 to 20

- Sell weakest speculative positions

- Increase stakes in quality companies

2. Add New Positions

- Energy sector (1-2 companies)

- Possibly add infrastructure plays

3. Investment Regularity

- Return to monthly contributions

- Even small amounts matter

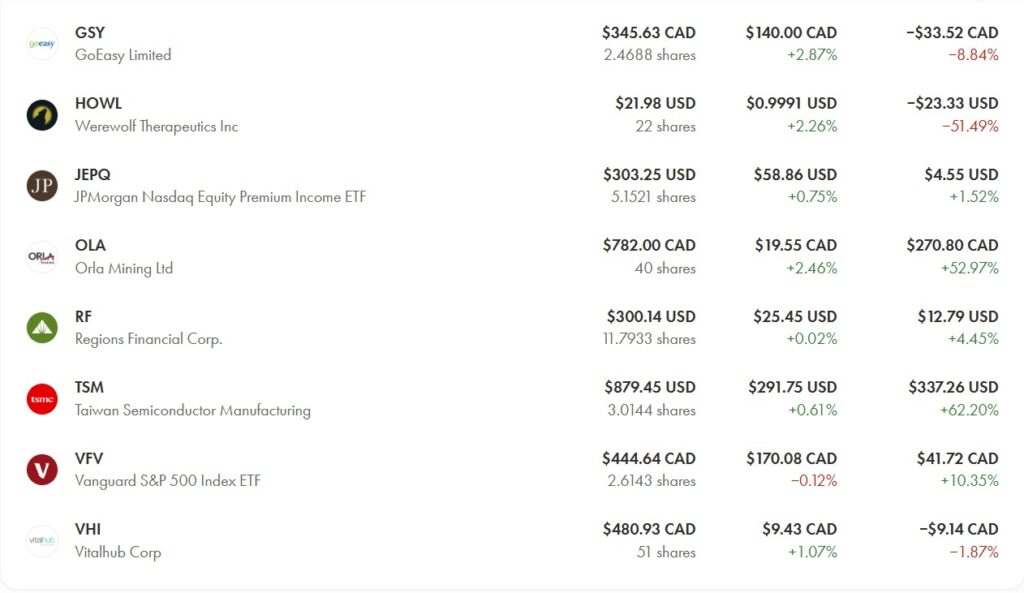

💡 Dividends and Passive Income

Dividends received for October-November: ~CAD $37 (didn’t track exact monthly breakdown)

Total dividends since start of investing: CAD $128.85

Of which last 3 months: CAD $43.80

Dividend income is growing with the portfolio. From small CAD $6.95 in September to approximately CAD $18-19 per month now.

Dividend positions in portfolio:

- RF (Regions Financial Corp) – quarterly

- JEPQ (JPMorgan Nasdaq Equity Premium Income ETF) – monthly

- UNH (UnitedHealth Group) – quarterly

📈 Year-to-Date Statistics

Overall Metrics:

- YTD Return: +58.96%

- Best Month: September 2025 (+11.6%)

- Second Best Month: October-November (+11.8% over 2 months)

- Number of Trades: 3 (DFLI, HOWL, + one more)

- Total Number of Positions: 29 stocks/ETFs

Best YTD Investments:

- CLS: +423.00% 🏆

- AMD: +119.82% 🥈

- TSM (TFSA): +60.04% 🥉

- AEM: +68.95%

- APP: +57.66%

Worst YTD Investments:

- HOWL: -51.49% 💔

- DV: -29.14%

- BBAI: -27.52%

- SRTS: -27.79%

- SPCB: -24.02%

📊 Detailed Portfolio Analysis

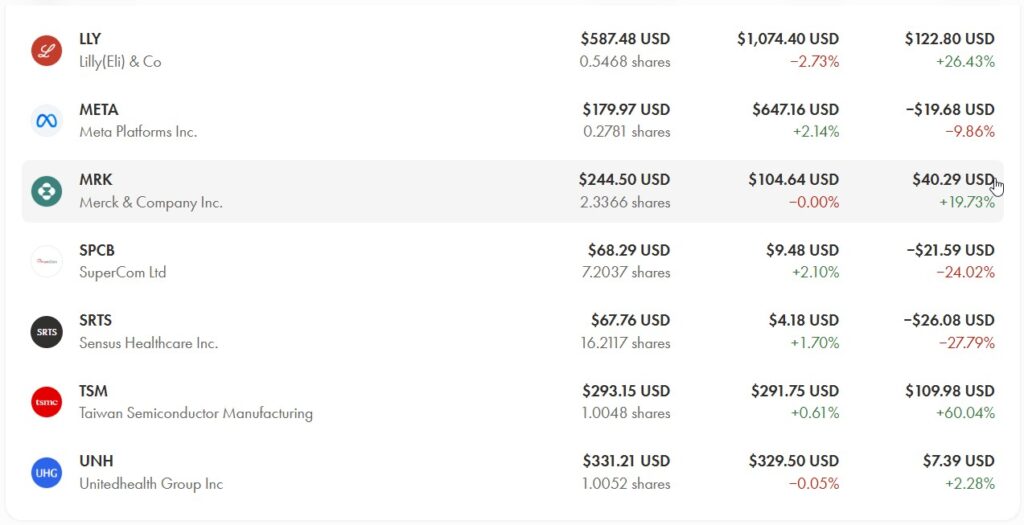

TFSA Portfolio (Tax-Free Savings Account)

Value: ~$3,670 USD

Main Positions:

- APP: $474.20 USD (+57.66%)

- INVZ: $295.26 USD (+16.55%) – significant correction

- IONQ: $121.08 USD (+20.70%)

- AMZN: $233.11 USD (+5.19%)

- META: $179.97 USD (-9.86%)

Character: More aggressive, tech-focused

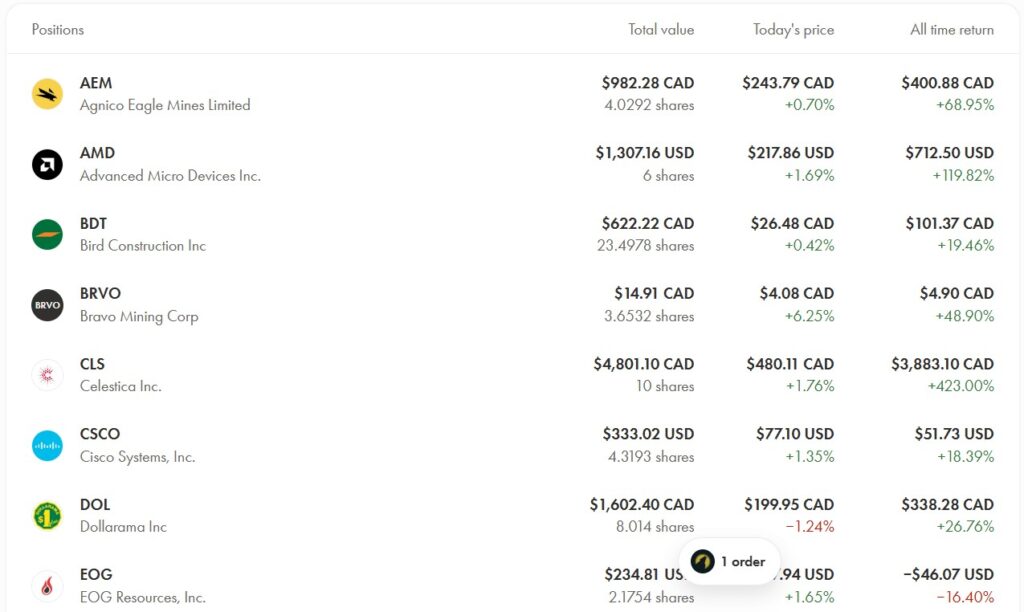

RRSP Portfolio (Registered Retirement Savings Plan)

Value: ~$16,050 CAD + USD

Main Positions:

- CLS: $4,801.10 CAD (+423.00%) – dominant position

- AMD: $1,307.16 USD (+119.82%)

- DOL: $1,602.40 CAD (+26.76%)

- AEM: $982.28 CAD (+68.95%)

- TSM: $879.45 USD (+62.20%)

Character: More stable, diversified

❓ Discussion Questions

Interested to hear your thoughts:

- What would you do with HOWL? Would you sell immediately at -50% or wait for recovery?

- CLS already +423% – isn’t it time to take profits? What are your rules for selling winners?

- How many positions are optimal for a private investor? 15? 20? 30?

- Energy sector – which companies are you considering in the context of AI boom?

Write in the comments, I’ll be happy to discuss! 💬

📊 Summary

October and November became a real test for the portfolio and my nerves. YTD return reached nearly 59%, significantly exceeding market indices. So far, my portfolio strategy is working well.

November correction was an important lesson: a drop of 8-10% looked scary, but holding positions proved to be the right decision. By month’s end, the portfolio almost fully recovered.

Fear & Greed Index is still in the fear zone, which historically means good opportunities for long-term investors. The market is scared, but fundamental indicators of quality companies (CLS, AMD, TSM) remain strong.

The key to success remains unchanged – concentration in quality tech companies plus patience during volatility. At the same time, new challenges emerged: HOWL showed that not all investments are successful, and some speculative positions need reassessment.

December will be a month of important decisions regarding rebalancing and portfolio optimization.

Main lesson: quality matters more than quantity, and patience matters more than emotions. Better to have 15-20 well-researched positions and hold them through corrections than to sell in panic. I tried to pick the best Canadian stocks, but so far not all of them have performed well.

Thank you for reading my reports! See you in December’s report! 🎄📈

Disclaimer: This post is not investment advice. All investments carry risks, and past performance does not guarantee future results. Always conduct your own research or consult with a financial advisor before making investment decisions.

#investing #stocks #stockmarket #portfolio #Celestica #AMD #AppLovin #AI #techstocks #TFSA #RRSP #dividends #finance #november2025 #october2025 #investmentreport #semiconductors #passiveincome #financialliteracy #marketcorrection #fearandgreed

Subscribe for monthly reports and investment insights!

Read previous report for September →

Читати “Інвестиційний звіт за жовтень-листопад 2025” українською >.