Agnico Eagle Mines: Attractive Investment Amid Gold’s Rally. Buy?

The price of gold per ounce has surpassed the $3,700 USD mark. Over the past month, it has risen by more than 11%, over the past year by 43%, and over the past five years by nearly 90%. Quite a surge, isn’t it? Naturally, the shares of gold-related companies have also followed this upward trend.

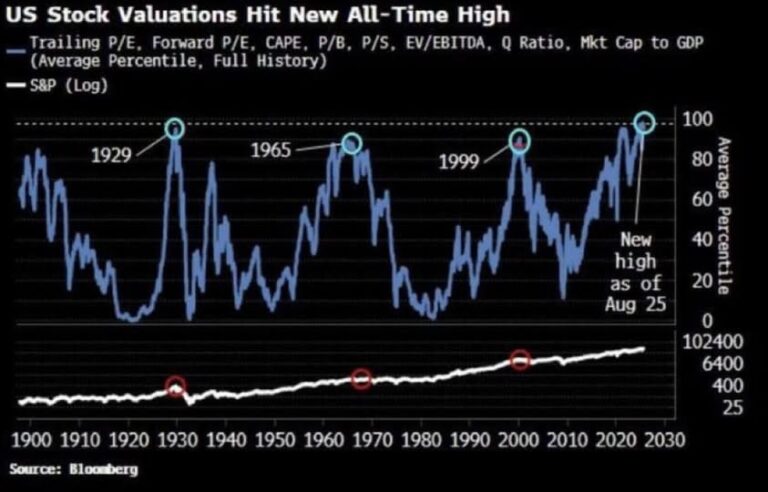

What Drives the Price of Gold Higher?

The rising trend in gold prices is driven by several factors:

- High inflation — gold is traditionally seen as a hedge against inflation. Since gold supply is relatively fixed, its value holds steady, making it a reliable store of wealth.

- Weakening US dollar — because gold is priced in USD, a weaker dollar makes it cheaper for international buyers, increasing demand and pushing the price up.

- Safe-haven demand — geopolitical tensions, fears of recession, and general uncertainty in global markets fuel gold purchases by investors looking to protect their capital.

In addition to physical gold, investors have an alternative: gold mining companies. One such company is the focus of this article.

Agnico Eagle Mines 2024 Financial Highlights

Company Overview

Agnico Eagle Mines Limited is a Canadian gold producer founded in 1957. Since 1983, it has paid dividends to shareholders. Today, it operates 10 mines across 4 countries, producing not only gold but also silver, zinc, and copper.

The company expects its total cash cost per ounce of gold in 2025 to be $1,250–1,300 USD (compared to $1,239 in 2024). With gold at $3,720 USD/oz at the time of writing, the margins look highly favorable.

AEM is part of my portfolio. Its ticker is TSX:AEM (the “TSX” means the shares are traded on the Toronto Stock Exchange, but the company is also listed on the NYSE). At the moment, I am very satisfied with my investment in AEM.

The company operates in politically stable mining-friendly jurisdictions: Canada, Europe, Latin America, and the US. This significantly reduces risk. It also pays dividends. Over the last 10 years, AEM stock has risen by 596%, and with dividend reinvestment the return would be almost 735%. That means a $10,000 investment 10 years ago would now be worth nearly $70,000–83,500. Over the past year alone, shares are up 86%.

⚠️ Important Disclaimer

- This is NOT financial advice.

- These are personal investment ideas based on fundamental analysis.

- Always do your own research.

- Never invest more than you can afford to lose.

📑 Full Investor Analysis of Agnico Eagle Mines (AEM)

1. Income Statement

- Revenue: steady growth to ~7–8B CAD.

- Net Income: consistently positive.

- Profit Margin: 15–20% (above average for the mining sector).

2. Balance Sheet

- Total Assets: 29,987M CAD (2024) → tripled in 3 years.

- Total Liabilities: 9,154M CAD → ~30% of assets.

- Equity: 20,833M CAD → up 3.5× in 3 years.

- Total Debt: 1,282M CAD → significantly reduced.

- Net Debt: 217M CAD → nearly debt-free.

- Working Capital: 1,293M CAD → stable liquidity.

3. Cash Flow

- Operating Cash Flow (OCF): 5,106M CAD in 2024 (+280% over 5 years).

- Free Cash Flow (FCF): 3,072M CAD in 2024 (+670% over 5 years).

- Cash at Year End: 1,560M CAD → 8× higher than in 2020.

4. Key Ratios

Liquidity

- Current Ratio: ~1.3 (positive working capital, strong short-term solvency).

- Quick Ratio: lower (due to high inventory levels, typical for mining).

Financial Stability

- Debt-to-Equity (D/E): 0.06 → virtually debt-free.

- Debt-to-Assets: ~30% → low leverage.

- Net Debt/EBITDA: near zero.

Profitability

- Gross Margin: ~50% (boosted by gold prices).

- Operating Margin: ~25%.

- Net Margin: 15–20%.

Efficiency

- ROE: ~7–9% (steady, not extraordinary).

- ROA: ~4–5%.

- ROIC: trending upward.

Market Valuation

- P/E: ~17–20 (average for gold miners).

- P/B: ~1.2 → fairly valued.

- Dividend Yield: ~3.2% → consistent payouts.

- P/FCF: <15 → attractive level.

5. Risks

⚠️ High CAPEX → requires continuous investment.

⚠️ Share dilution → share count nearly doubled in 3 years.

⚠️ Commodity dependence → earnings heavily tied to gold/silver prices.

📊 Investor Takeaway

✅ Agnico Eagle Mines boasts low debt, strong cash flows, and steady dividends.

✅ Financial stability and liquidity are robust.

✅ Valuation metrics (P/E, P/B, P/FCF) suggest the company is fairly — even attractively — priced.

💡 For long-term investors, AEM represents a stable dividend stock with minimal bankruptcy risk, but performance remains directly tied to gold prices.

Read in Ukrainian: Agnico Eagle Mines stock report.