Investment Report for December 2025: Champion’s Correction and New Horizons

Reading time: ~8 minutes

📈 Key Performance Metrics (December)

Total Portfolio Return: -4.7% (for the month)

Return vs S&P 500: -2.8%

YTD Return: +44.21%

Total Portfolio Value: $19,547.47 CAD

Net deposits (invested since February): $13,555 CAD

Realized Profit: +$5,992.47 CAD

Quick Overview

December became a month of correction and strategy rethinking. After two successful months (+11.8% in October-November) came the cooling: portfolio lost 4.7%. The portfolio star – Celestica – suffered most, correcting from +423% to +342%.

Key Events of the Month:

- Celestica correction – drop from $4,801 to $4,060 CAD

- INVZ crash – went into negative zone: +16.55% → -22.61%

- MRK sale – realized small profit ✅

- New strategic positions: Nuclear Energy ETF (NLR) and Crypto ETF (XRP)

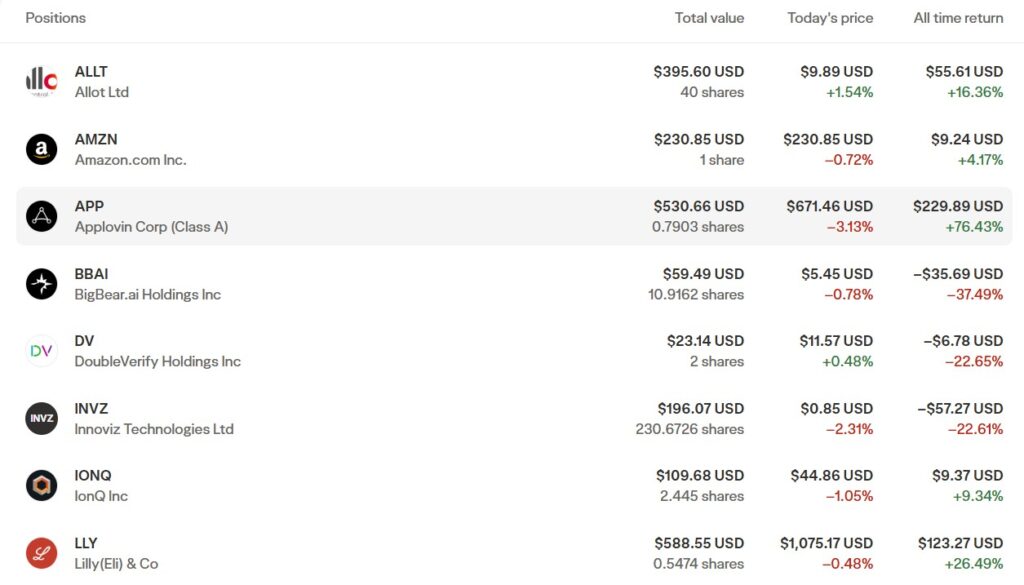

- APP continues growth – reached +76.43%

- HOWL worsened to -69.20%

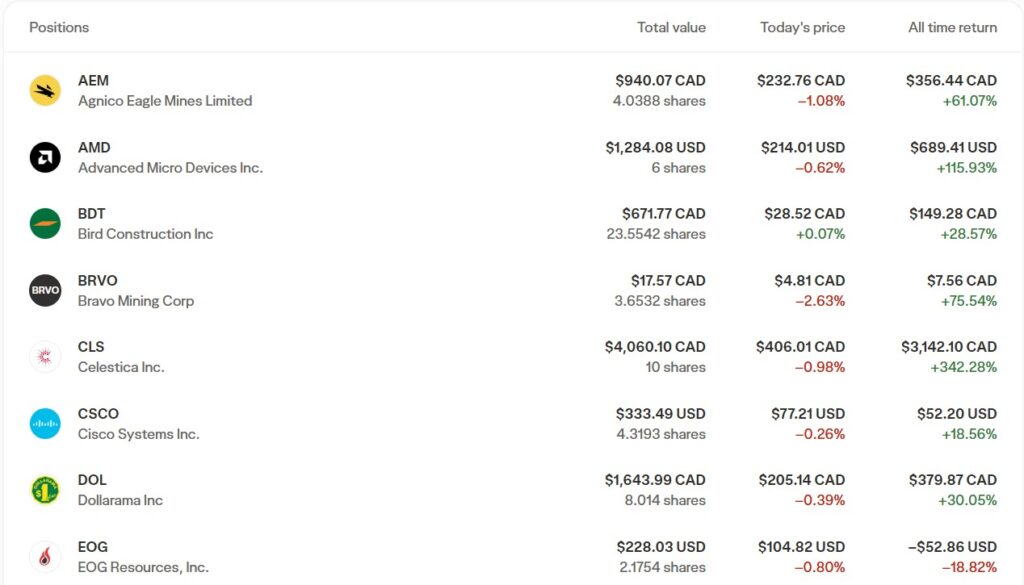

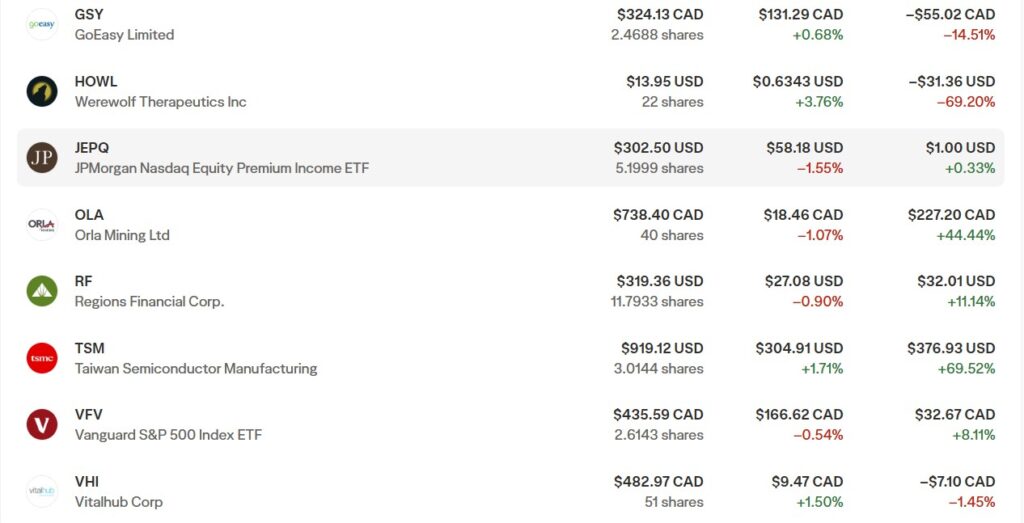

🎯 Top Positions of the Month

🔴 Biggest Drops of the Month

1. Celestica Inc ($CLS) – -15.4% 📉

- End of November: $4,801.10 CAD (+423%)

- End of December: $4,060.10 CAD (+342.28%)

- Change for month: -15.4%

- My position: 21.83% of RRSP portfolio (was 24.35%)

- Comment: Most painful drop of the month. Portfolio champion corrected, but still remains solidly in profit. Didn’t sell – company quality hasn’t changed.

2. INVZ (Innoviz Technologies) – -33.6% 📉📉

- End of November: $295.26 USD (+16.55%)

- End of December: $196.07 USD (-22.61%)

- Change for month: -33.6%

- Comment: Speculative position crash. Went from profit to loss. Needs decision.

3. HOWL (Werewolf Therapeutics) – additional -36.5%

- End of November: $21.98 USD (-51.49%)

- End of December: $13.95 USD (-69.20%)

- Change for month: -36.5%

- Comment: Continues decline. Worst investment of the year.

🟢 Month’s Leaders

1. AppLovin Corp ($APP) – +11.9% 🚀

- End of November: $474.20 USD (+57.66%)

- End of December: $530.66 USD (+76.43%)

- Change for month: +11.9%

- My position: 14.34% of TFSA portfolio

- Comment: Continues strong growth after S&P 500 inclusion!

2. BDT (Bird Construction) – +8.0%

- Growth from $622.22 CAD to $671.77 CAD

- All time return: +28.57%

3. BRVO (Bravo Mining) – +18.0%

- Growth from $14.91 CAD to $17.57 CAD

- All time return: +75.54%

💼 New Investments and Portfolio Changes

New Purchases

$NLR (VanEck Uranium + Nuclear Energy ETF) – 6.1254 shares

- Position value: $767.21 USD

- All time return: -10.46%

- Investment thesis: Nuclear energy is experiencing a renaissance. AI requires massive amounts of stable energy, and nuclear power is the ideal solution. Uranium and nuclear industry companies are on a long-term rise.

- Strategy: Long-term hold, possible additions on dips

$XRP (Evolve XRP ETF CAD Unhedged) – 33 shares

- Position value: $270.60 CAD

- All time return: -7.15%

- Investment thesis: Bought after significant XRP drop. Ripple has real use cases in international payments, and cryptocurrencies are showing strength as an asset class.

- Strategy: Speculative position, plan to add more on further drops

- Risk: High! Crypto is volatile, but this is only ~1.5% of portfolio

Sales

$MRK (Merck & Company) – sold completely

- Reason for sale: Position wasn’t showing sufficient growth compared to tech

- Result: Small profit realized ✅

- Comment: Freed capital for more promising opportunities (NLR, XRP)

Position Adjustments

- Most positions remained unchanged

- December was a month of observation and analysis

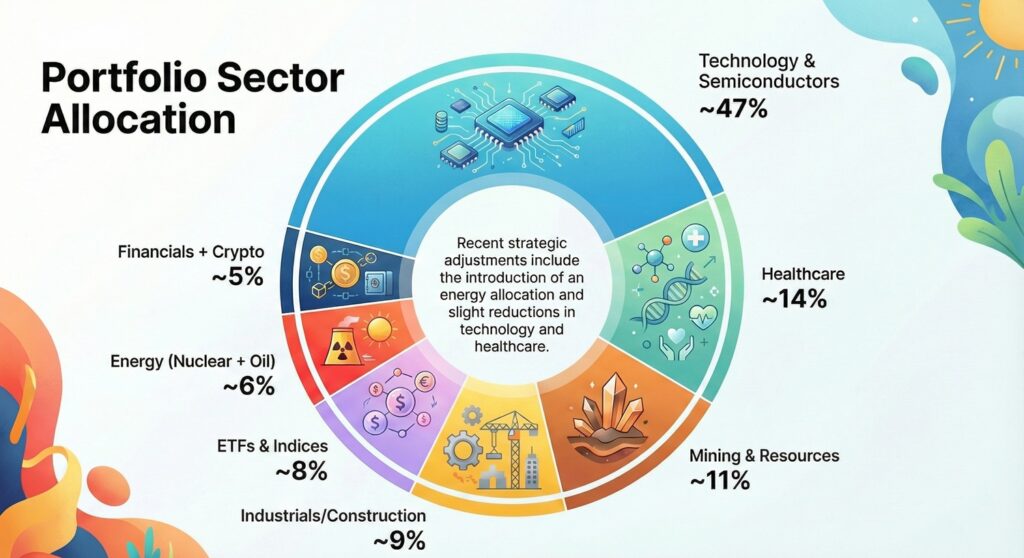

📊 Portfolio Sector Allocation

💻 Technology & Semiconductors: ~47% (↓ from 48%)

⚡ Energy (Nuclear + Oil): ~6% (↑ NEW!)

💊 Healthcare: ~14% (↓ from 16%)

⛏️ Mining & Resources: ~11%

🏗️ Industrials/Construction: ~9%

📈 ETFs & Indices: ~8%

💰 Financials + Crypto: ~5%

Changes: Added energy sector (NLR), sold MRK from healthcare, added crypto exposure (XRP).

🌍 What Influenced the Market in December

Macroeconomic Factors

- Fed held rates – pause in rate cut cycle led to correction

- Overheated market – after powerful rally came profit-taking

- Tax loss harvesting season – many investors realized losses for tax deductions

- Strong dollar – pressured international companies

December Sentiment

What Happened:

- Tech stocks corrected after strong year

- Celestica suffered most (-15%)

- Small speculative positions continued weakness

- Crypto showed volatility

Why It Matters:

- Normal correction after +57% YTD

- Time for position reassessment

- Rebalancing opportunities

Corporate and Sector News

- Celestica – technical correction after powerful growth

- AI boom continues – but valuations became stretched

- Nuclear energy – growing investor interest

- Ripple/XRP – volatility, but long-term prospects remain

📝 December Lessons

What Worked Well ✅

1. Diversification saved the portfolio

- 15% CLS drop didn’t crash entire portfolio thanks to other positions

- APP compensated part of losses with its growth

2. Didn’t panic during correction

- CLS fell, but I didn’t sell

- Company quality hasn’t changed

- Temporary correction after +423% is normal

3. MRK sale was correct

- Freed capital for better opportunities

- Pharma lags behind tech

4. New strategic directions

- Nuclear energy – long-term trend

- Crypto exposure – asset class diversification

What Can Be Improved 📚

1. INVZ and HOWL – painful drops

- INVZ: -33% for month, -22.61% overall

- HOWL: -69.20% overall

- Speculative positions under pressure

- Decision: Continue holding, hoping for recovery 🤞

2. MRK – correct timing for sale

- Sold after growth with small profit

- Freed capital for more promising sectors (Nuclear, Crypto)

- Right rebalancing decision ✅

3. CLS too large share

- Even after drop it’s 21.83% of portfolio

- Should have taken partial profits at +423%

Key Takeaways 💡

1. Corrections are normal

- After +57% YTD, seeing -4.7% month is expected

- This is healthy correction, not crash

2. Winners don’t always grow

- CLS showed that even champions correct

- Important to take partial profits

3. Time for rebalancing

- Too many weak speculations

- Need to increase quality positions

4. New opportunities in correction

- Nuclear energy – long-term trend

- Crypto on dips – entry opportunity

🔮 Plans for January 2026

Critical Decisions 🎯

1. Speculative positions – continuing to hold

- HOWL (-69.20%) – holding, waiting for recovery

- INVZ (-22.61%) – holding, waiting for recovery

- BBAI (-37.49%) – holding

- SPCB (-28.03%) – holding

- SRTS (-32.28%) – holding

- Strategy: Not selling at bottom, waiting for possible recovery

2. CLS – take a pause

- Not selling, but not adding

- Waiting for stabilization

- If drops to +300%, will consider adding

3. Add to quality positions

- AMD – if drops below $200

- TSM – always good quality

- NLR – if nuclear sector corrects more

What I’m Watching 👀

Nuclear Energy:

- Long-term trend due to AI needs

- NLR as exposure to entire sector

- Possible additional positions: CCJ, UUUU

Cryptocurrencies:

- Plan to add XRP on dips

- Possibly add Bitcoin exposure (BTCC.B ETF)

January Reports:

- CLS, AMD, TSM – important to see fundamentals

- Will strong earnings continue?

Strategic Goals 🎯

1. Clean up portfolio

- Sell 5 weakest positions

- Reduce from 29 to 24 positions

- Focus on quality

2. Rebalance

- Reduce CLS from 21.83% to ~15-17%

- Increase AMD, TSM, APP

- Add to nuclear and crypto on dips

3. Establish profit-taking rules

- At +300% sell 25% of position

- At +500% sell another 25%

- This way can take profits but stay in game

💡 Dividends and Passive Income

Dividends received in December: ~CAD $38.50

Total dividends since start of investing (February 2025): CAD $167.20

Last quarter (October-December): CAD $75.50

Dividend income continues to grow:

- February-September: CAD $91.70

- October-December: CAD $75.50

- Current monthly average: ~CAD $25

Dividend positions in portfolio:

- RF (Regions Financial Corp) – quarterly

- JEPQ (JPMorgan Nasdaq Equity Premium Income ETF) – monthly

- UNH (UnitedHealth Group) – quarterly

Annual projection (if portfolio unchanged): ~CAD $300

📈 Year-to-Date Statistics (YTD 2025)

Overall Metrics:

- YTD Return: +44.21%

- Best Month: September 2025 (+11.6%)

- Worst Month: December 2025 (-4.7%)

- Total invested: $13,555 CAD

- Current value: $19,547.47 CAD

- Earned: +$5,992.47 CAD

- Number of trades for year: ~8-10

- Total number of positions: 28 stocks/ETFs (was 29)

Best Investments of the Year:

- CLS: +342.28% 🏆 (was +423%)

- AMD: +115.93% 🥈

- APP: +76.43% 🥉

- BRVO: +75.54%

- TSM (RRSP): +69.52%

- AEM: +61.07%

Worst Investments of the Year:

- HOWL: -69.20% 💔

- BBAI: -37.49%

- SRTS: -32.28%

- SPCB: -28.03%

- DV: -22.65%

- INVZ: -22.61%

Year Statistics:

- Total gain: +$5,992.47 CAD

- Total invested: $13,555 CAD

- Return: +44.21%

- Win rate: ~60% (17 of 28 positions in profit)

- Biggest winner: CLS (+342%)

- Biggest loser: HOWL (-69%)

📊 Detailed Portfolio Analysis

TFSA Portfolio (Tax-Free Savings Account)

Value: ~$5,665 CAD

Main changes of the month:

- APP grew to +76.43%

- INVZ crashed to -22.61%

- Added XRP (-7.15%)

Main Positions:

- APP: $530.66 USD (+76.43%) – continues to lead

- AMZN: $230.85 USD (+4.17%)

- META: $183.24 USD (-8.25%)

- INVZ: $196.07 USD (-22.61%) – needs decision

- IONQ: $109.68 USD (+9.34%)

Character: Aggressive, tech-focused, added crypto exposure

RRSP Portfolio (Registered Retirement Savings Plan)

Value: ~$14,900 CAD

Main changes of the month:

- CLS corrected by -15.4%

- Sold MRK

- Added NLR (-10.46%)

Main Positions:

- CLS: $4,060.10 CAD (+342.28%) – still dominant

- AMD: $1,284.08 USD (+115.93%)

- DOL: $1,643.99 CAD (+30.05%)

- AEM: $940.07 CAD (+61.07%)

- TSM: $919.12 USD (+69.52%)

- NLR: $767.21 USD (-10.46%) – new strategic position

Character: More stable, diversified, added nuclear energy

❓ Discussion Questions

Interested to hear your thoughts:

- Is it right to sell CLS after drop from +423% to +342%? Or is this just healthy correction?

- Nuclear energy – hype or long-term trend? What do you think about NLR?

- Crypto ETF (XRP) – is this diversification or unnecessary risk?

- When to sell losers? HOWL -69%, INVZ -22%, BBAI -37% – sell now or wait for recovery?

Write in comments, happy to discuss! 💬

📊 Year Summary

December concluded my first full year of investing with +44.21% YTD result. Over 11 months (February-December 2025) invested $13,555 CAD, and portfolio grew to $19,547.47 CAD. Earned +$5,992.47 CAD!

This is significantly better than S&P 500 (~25% for year) and outperforms most professional funds.

What worked:

- Concentration in tech/AI (CLS, AMD, APP, TSM)

- Patience with best positions

- Didn’t sell on corrections

What didn’t work:

- Speculative small positions (HOWL, INVZ, BBAI)

- Too many positions (28-29)

- Didn’t take profits in time (CLS at +423%)

Main lessons of the year:

- Quality beats quantity – 5 quality companies gave 90% of profit

- Take profits – CLS at +423% should have been partially sold

- Sell losers faster – don’t wait for -70%

- Diversification works – different sectors save during corrections

- Patience matters more than emotions – all corrections recovered

Plans for 2026:

- Clean portfolio of weak positions

- Focus on 15-20 quality companies

- Profit-taking rules

- New sectors: nuclear, infrastructure, possibly more crypto

First year taught me more than any books. Mistakes were expensive, but lessons priceless.

Thank you to everyone who read my reports throughout the year! See you in 2026! 🎊📈

Disclaimer: This post is not investment advice. All investments carry risks, and past performance does not guarantee future results. Always conduct your own research or consult with a financial advisor before making investment decisions.

SEO Tags

#investing #stocks #stockmarket #portfolio #Celestica #AMD #AppLovin #NuclearEnergy #AI #techstocks #TFSA #RRSP #dividends #finance #december2025 #yearreview #YTD2025 #investmentreport #nuclearenergy #crypto #XRP #semiconductors #passiveincome #financialliteracy

Subscribe for monthly reports and investment insights!