This AI Stock Grew 60% and Got Crushed. Here Are 3 Reasons Why.

Introduction: The Hidden Gears of the AI Revolution

The artificial intelligence boom has sparked an unprecedented investment rush. Billions are pouring into building massive data centers, and investors are frantically searching for the next big winner. But history shows that during a gold rush, the most enduring fortunes are made not by those mining for gold, but by those selling the picks and shovels. In the 21st-century gold rush for AI, the “gold” is computational power, and the “picks and shovels” are the essential infrastructure—like backup power generators—that makes the entire revolution possible.

This brings us to a fascinating puzzle in today’s market. Imagine a company providing these critical “picks and shovels” for the AI revolution. A company whose revenue just skyrocketed by over 60% year-over-year, directly fueled by the insatiable demand from data centers. Logic suggests its stock would be soaring. Instead, its share price was cut in half, falling from a high of around $120 to just $60.

What happened? The answer lies beyond the headline numbers, revealing a complex story about growth, risk, and market perception. Here are the three most surprising reasons behind this paradox.

1. From School Buses to Supercomputers: An Unlikely AI Hero

Power Solutions International (PSIX) began its life in a decidedly low-tech world. The company’s traditional business was manufacturing engines for the workhorses of the economy: industrial vehicles like forklifts, lifts, and airport ground equipment, as well as its transportation segment which powers school buses and trucks. But while that part of its business stagnated, another was quietly transforming into an AI powerhouse.

The company’s most explosive growth now comes from its “Power Systems” segment. These aren’t engines for moving vehicles; they are the core components of industrial generators. In the age of AI, these generators serve a critical function: providing the massive amounts of reliable backup power required to keep energy-hungry data centers online 24/7. They also serve the demanding energy sector.

This pivot has turned PSIX from a simple engine maker into a hidden infrastructure play on the AI boom. It’s a company whose most valuable product isn’t on the highway, but sitting silently in a server farm, ready to power the future of computing.

2. The Paradox of Hyper-Growth: Why Spectacular News Tanked the Stock

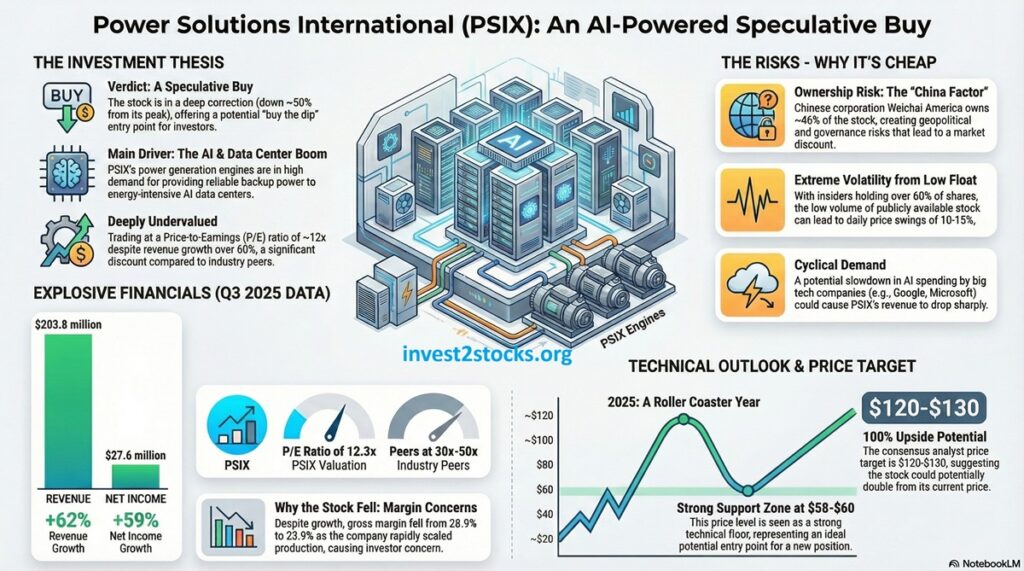

On paper, the company’s Q3 2025 financial results were nothing short of phenomenal. The numbers painted a picture of a business firing on all cylinders:

- Q3 2025 Revenue: $203.8 million (a 62% increase year-over-year)

- Q3 2025 Net Income: $27.6 million (a 59% increase year-over-year)

With growth figures like these, investors should have been celebrating. Yet, following this spectacular news, the stock price plunged. The reason wasn’t a flaw in the growth story, but a strategic trade-off in how that growth was achieved. The culprit was a single line item in the financial report: the company’s gross margin had declined from 28.9% to 23.9%.

To the market, this signaled that the company’s impressive growth might be “unprofitable growth,” raising fears that its most profitable days were already in the past. However, this drop wasn’t a sign of a failing business. Rather, it was a deliberate strategic choice. To meet overwhelming demand and capture market share, management consciously accepted production inefficiencies and sold more lower-margin products. This aggressive expansion, backed by a new $135 million credit line secured in August 2025, represents a calculated sacrifice of short-term profitability for what the company hopes will be long-term market dominance—a bold strategy that Wall Street is second-guessing.

3. The Valuation Riddle: Why It’s Dirt Cheap Despite Insane Growth

Even after its fall, the most puzzling aspect of PSIX is its valuation. At its current price, the stock trades at a Price-to-Earnings (P/E) ratio of around 12.3. To put that in perspective, this is an extremely low valuation for any company, let alone one growing its revenue at over 60%. Other companies providing data center infrastructure often trade at P/E ratios of 30x to 50x. So, why the massive discount? The key question for the valuation is whether the market is correctly pricing in a unique set of risks.

First is the ownership structure. Approximately 46% of Power Solutions International is owned by Weichai America, a subsidiary of a major Chinese corporation. This classifies PSIX as a “controlled company,” which investors discount due to the perceived risks of a single entity having immense influence and the broader geopolitical tensions between the U.S. and China. This presents a classic risk/reward scenario, however, as the relationship with Weichai also provides a key advantage: access to cheaper supply chains.

Second, this ownership concentration creates a “low float,” meaning very few shares are available for public trading. The result is extreme volatility—it’s not uncommon for the stock to swing 10-15% in a single day without news, scaring away many investors. Finally, there is a significant cyclical risk. Demand for data center generators is frantic now, but if big-tech giants like Google and Microsoft reduce their AI spending, PSIX’s revenues could fall sharply.

Conclusion: A Story of Growth, Risk, and Perception

The story of Power Solutions International is a powerful reminder that headline numbers rarely tell the whole story. It’s a tale of a company that successfully transformed itself into a key supplier selling the “picks and shovels” of the AI revolution, only to be punished by the market for the very speed of its success and undervalued because of risks both internal and external.

Investors are weighing a complex equation: explosive, well-funded growth on one side, against the pressures of margin compression, concentrated ownership, and the cyclical nature of tech spending on the other. This leaves a final, thought-provoking question for any market observer: In a market chasing the next big thing, is the deep discount on PSIX a sign of an overlooked opportunity, or is it a clear warning that some risks just aren’t worth the price?

⚠️ Disclaimer: This article is not financial advice or an investment recommendation. Always conduct your own research (DYOR) and consult with a financial advisor before making investment decisions.

Blog Tags: #PSIX #PowerSolutionsInternational #AI #artificialintelligence #investing #datacenters #stocks #stockmarket #valueInvesting #Weichai #technology #stockanalysis #USstocks #infrastructure #energy

Read in Ukrainian: “Ця акція злетіла в 6 разів, а потім впала вдвічі. Розбираємо «темну конячку» AI-буму“.