US Stock Market: Historic Overvaluation or New Reality?

🚨 Context: Warning Signal or False Alarm?

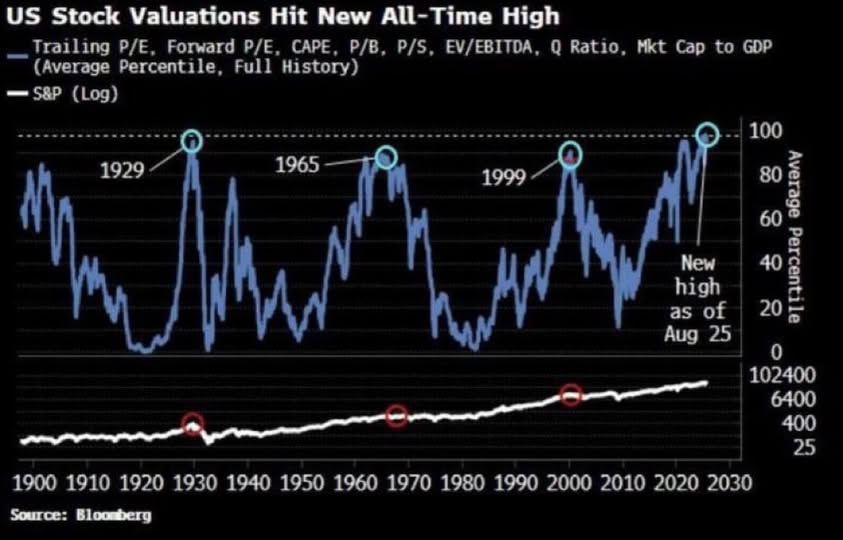

According to Bloomberg, the US stock market has reached its most expensive valuation in history, surpassing the Dot-Com Bubble peak (2000) and levels before the Great Depression (1929).

Buffett Indicator (Market Cap / GDP):

- Now: 215%+

- Dot-Com peak (2000): 175%

- Historical norm: 100-130%

Warren Buffett called investing in such environment “playing with fire”.

But is it really that straightforward?

⚖️ THE DEBATE: Two Opposing Views

🔴 VIEW 1: “Market is Dangerously Overvalued”

📊 Historical Parallels:

Every time Buffett Indicator > 200%, it ended with corrections:

| Period | Buffett Indicator | What Happened |

|---|---|---|

| 1929 | ~140% | Crash -89% |

| 2000 | 175% | NASDAQ -78% |

| 2008 | ~135% | S&P 500 -57% |

| 2025 | 215% | ? |

⚠️ Other Warning Metrics:

- Shiller P/E (CAPE): ~35 (norm 16-17)

- Forward P/E: ~22 (norm ~15)

- Price-to-Sales: all-time highs

- Narrow leadership: 7 tech companies carrying entire market

💭 Arguments:

❌ “This time is different” – most dangerous words in investing

- There are always “logical” explanations why “now is different”

- 1990s: “Internet will change everything!” (yes, but prices were absurd)

- 2020s: “AI will change everything!” (yes, but…)

❌ AI hype may be overblown

- Real revolution, but results will come in years

- Currently paying for future profits of 2030-2035

- Risk of disappointment if AI doesn’t deliver quickly

❌ Risks are ignored:

- Geopolitics (conflicts, tariffs)

- Possible recession

- High interest rates

- “Black swans”

🎯 Skeptics’ Conclusion:

“History shows: extreme valuations always correct. Maybe not -80%, but -30-50% is quite realistic. Time to be cautious.”

🟢 VIEW 2: “This Time Is Actually Different”

🚀 Structural Changes That Didn’t Exist Before:

1️⃣ Democratization of Investing

2000 vs 2025:

- Commissions: $50-100 → $0

- Minimum: $10,000 → $1

- Access: broker phone call → mobile app

Result:

- 2000: ~52M Americans invested

- 2025: 150+ million people

- 3X more capital flowing into market!

2️⃣ Pension Funds = $1+ trillion annual demand

401(k) and IRAs:

- Assets: $20+ trillion

- Automatic contributions: $500+ billion annually

- Buybacks: $800+ billion annually

Structural demand of $1.3+ trillion/year regardless of valuations!

During 2000/2008 panic: everyone sold. Now: pension funds keep buying every month.

3️⃣ AI – REAL revolution, not hype

Critical Difference from Dot-Com:

| Dot-Com (2000) | AI Boom (2025) |

|---|---|

| Pets.com: $0 profit | NVIDIA: $60+ billion profit |

| Webvan: only losses | Microsoft AI: real sales |

| “Maybe in the future” | Working NOW |

| P/E = ∞ | P/E = 20-50 (high but not absurd) |

AI Investments (2024):

- $350+ billion annually

- Dot-Com peak: ~$50 billion

- 7X MORE!

4️⃣ Companies Earn SIGNIFICANTLY More

S&P 500 Net Profit Margins:

- 1990s: ~5-6%

- 2000: ~7%

- 2024: ~12-13% (almost DOUBLE!)

Tech giants = Cash machines:

- Apple cash flow: $100+ billion/year

- Microsoft: $80+ billion/year

- NVIDIA: $40+ billion net profit

- Total: $400+ billion in cash

In 2000, most companies burned money, didn’t earn it.

5️⃣ Globalization and Scale

S&P 500 companies:

- ~50% revenue OUTSIDE USA

- Market: 5+ billion smartphones vs 500M in 2000

- iPhone sold in 175 countries simultaneously

Companies earn on ENTIRE planet, not just USA!

6️⃣ Fed Has Learned

2008-2024: New Tools:

- Quick reaction (COVID: within weeks)

- Quantitative Easing

- Forward Guidance

- Ready to intervene instantly

Result: Lower probability of catastrophic -80% crash.

🎯 Optimists’ Conclusion:

“Valuations are high but fundamentally justified. AI revolution is real, companies generate record profits, structural demand is massive. May correct -20%, but not crash.”

💭 MY BALANCED OPINION

🤔 Both Sides Are Right:

✅ Truth from skeptics:

- Historically high valuations – fact

- “This time is different” always dangerous

- Risks ignored by market

- Correction will come sooner or later

✅ Truth from optimists:

- Structural changes truly massive

- AI – not hype, but reality

- Company quality much better

- Real profits, not fantasies

🎯 Most Likely Scenario:

Not catastrophe, but not endless growth either.

I expect:

- High volatility next 2-3 years

- Possible correction -20-30%, but not -80% crash

- Slower growth while valuations “normalize”

- AI will deliver, but needs time (3-5 years)

📝 WHAT SHOULD INVESTORS DO?

❌ DON’T:

- ❌ Panic and sell everything

- ❌ Completely ignore risks

- ❌ All-in on tech at peaks

- ❌ Leverage and margin trading

✅ Smart Strategy:

1. Diversification

- Not only tech

- Different sectors, regions

- Add defensive stocks

2. Hold cash (15-30%)

- Dry powder for opportunities

- Psychological comfort

3. Quality > hype

- Focus on profitable companies

- Reasonable P/E (<30-40)

- Strong balance sheets

4. Dollar Cost Averaging

- Don’t enter with large sums now

- Distribute investments over time

- Automatic monthly contributions

5. Stop-losses and protection

- Protect unrealized profits

- Trailing stops on growth positions

- Portfolio rebalancing

6. Long-term horizon

- If investing for 10+ years – don’t panic

- Corrections are part of the game

- Historically market always recovered

🎓 LESSONS FROM HISTORY

Warren Buffett: “Be greedy when others are fearful, and fearful when others are greedy”

Others are very greedy now. But this doesn’t mean sell everything.

It means be more cautious:

- Risk less

- Analyze more

- Prepare for volatility

- Keep reserves

🤝 OPEN QUESTION TO AUDIENCE

What do you think?

🔴 Market dangerously overvalued → time to reduce positions?

🟢 “This time is different” → AI will justify high valuations?

🟡 Balanced approach → cautious optimism with protection?

Share your thoughts in comments! 💬

Sources: Bloomberg, Buffett Indicator, S&P 500 historical data, Federal Reserve data

This is not financial advice. Always do your own research and consult with financial professionals.

Tags:

#StockMarket #Investing #AI #BuffettIndicator #MarketValuation #TechStocks #InvestingStrategy #RiskManagement #FinancialMarkets #LongTermInvesting #MarketCrash #DotComBubble #WarrenBuffett #SPX #NASDAQ

Read in Ukrainian: “Американський ринок: Історична переоцінка чи нова реальність?“.