Investment Report for September 2025: My Results and Market Analysis

Published: September 30, 2025 | Reading time: ~7 minutes

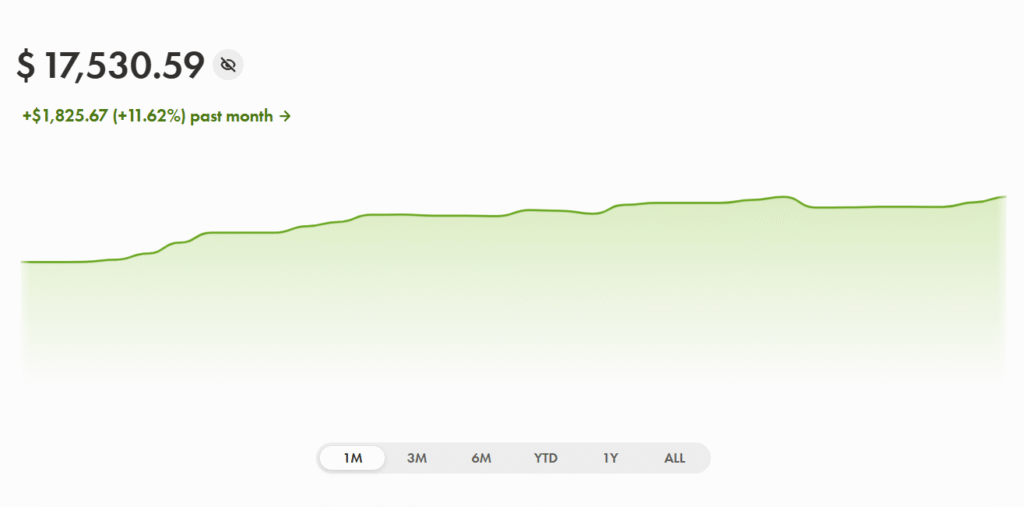

📈 Key Performance Metrics (September)

Total Portfolio Return: +11.6%

Return vs S&P 500: +8.1%

YTD Return: 41.43%

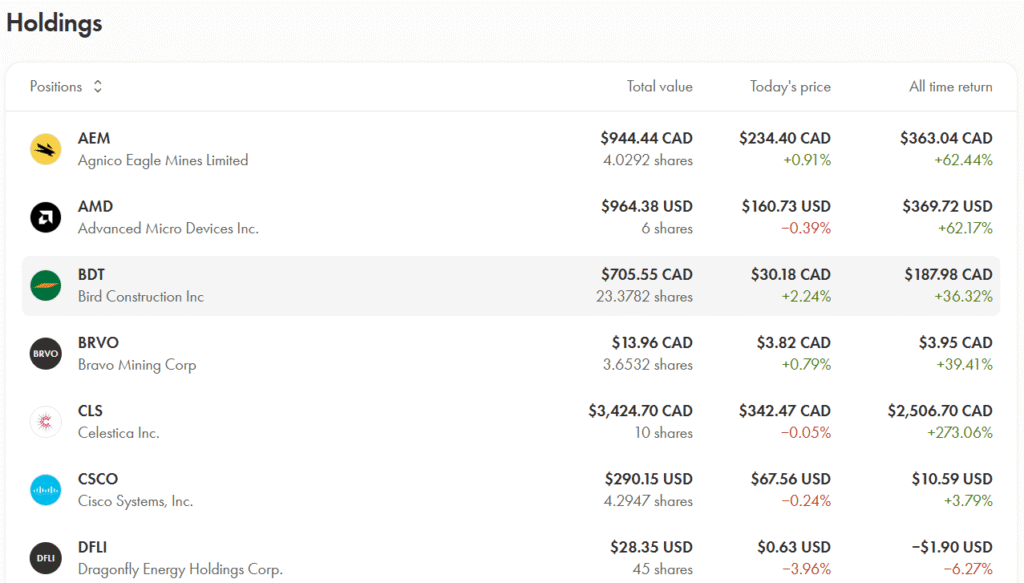

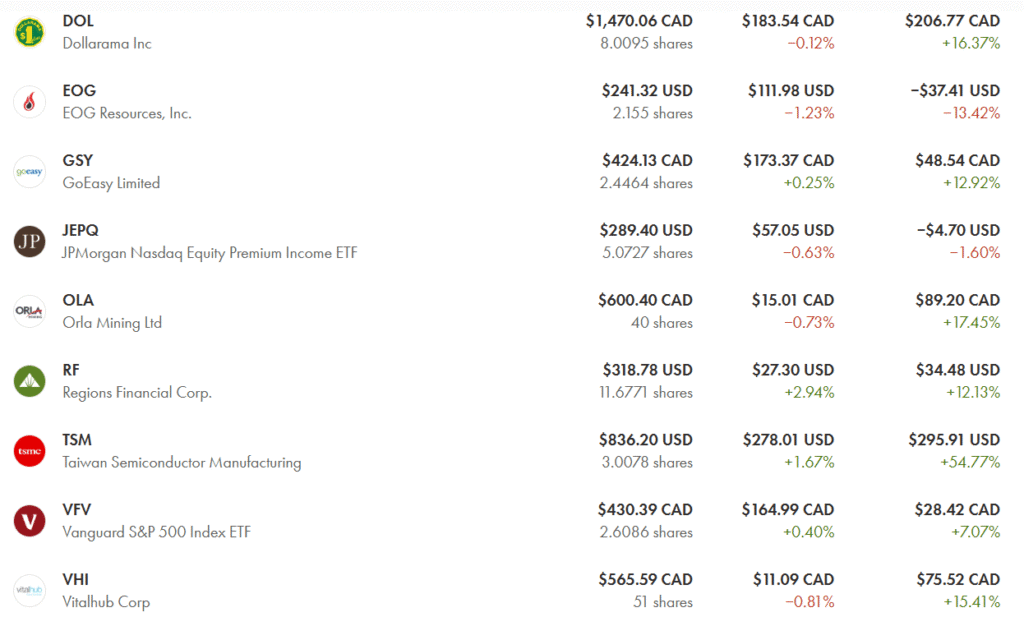

Total Portfolio Value: $17,526.97

Realized Profit/Loss: +$5,133.96

Quick Overview

September was probably the best month since I created my portfolio (February 2025). The biggest market driver was the 25 basis point rate cut. Notably, both the US and Canada made this move simultaneously, which further supported the markets.

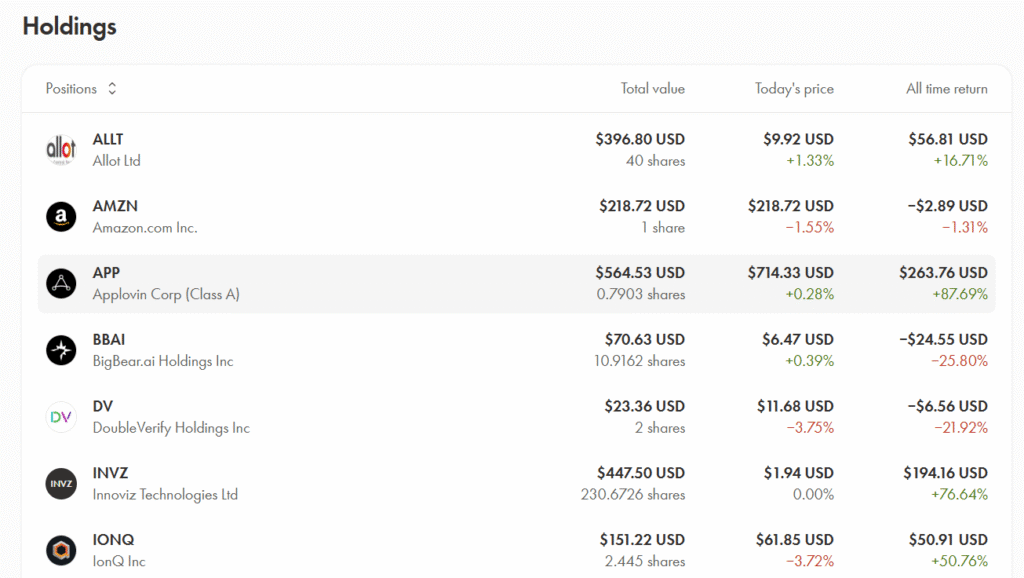

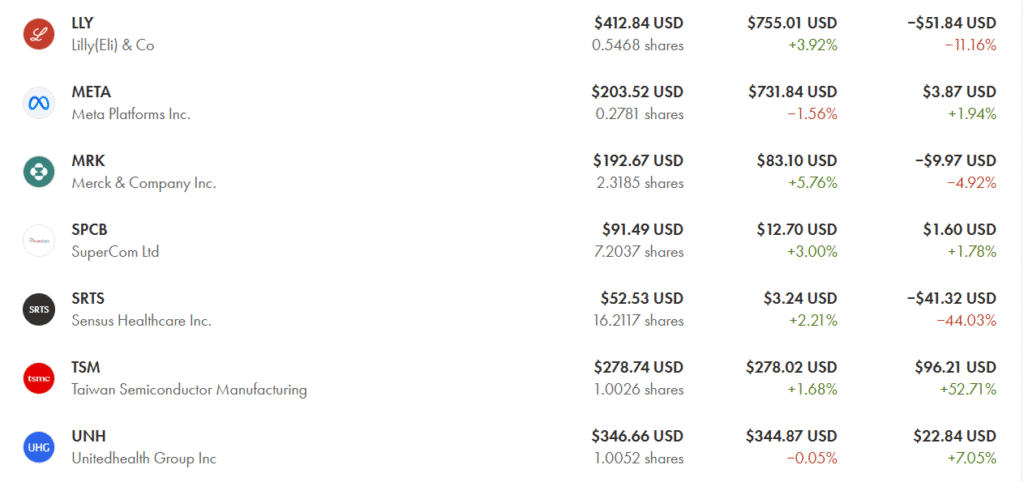

🎯 Top Positions of the Month

🟢 Growth Leaders

1. AppLovin Corp ($APP) – +49.7% 🚀

- Growth reason: The company was added to the S&P 500 index, leading to massive purchases by index funds

- My position: 16.35% of TFSA portfolio

- Comment: Phenomenal growth! S&P 500 inclusion is recognition of the company’s stability

2. Celestica Inc ($CLS) – +28.0% 📈

- Growth reason: Financial results exceeded expectations, improved guidance for upcoming quarters

- My position: 26.89% of RRSP portfolio

- Comment: My largest position continues to show strong results (+273% since initial investment)

🔴 Month’s Underperformers

1. DoubleVerify Holdings Inc ($DV) – -29.0% ⚠️

- Reason for decline: Negative news regarding financial metrics

- My reaction: This is a small investment, holding for now and monitoring the situation

- Comment: Worst performer of the month, but position size is minimal

💼 New Investments and Portfolio Changes

New Purchases

$DFLI (Dragonfly Energy Holdings Corp) – 45 shares at $0.63

- Investment thesis: Short-term speculative purchase, high risk, so I just used available cash in the account

- Target price: $0.72+

- Risk: High! This is an experimental position with minimal capital

Sales

No sales this month.

Position Adjustments

September passed without adjustments to existing positions.

📊 Sector Allocation

💻 Technology & Semiconductors: ~45%

💊 Healthcare: ~18%

⛏️ Mining & Resources: ~12%

🏗️ Industrials/Construction: ~9%

📈 ETFs & Indices: ~9%

💰 Financials: ~8%

🌍 What Influenced the Market in September

Macroeconomic Factors

- Fed rate cut by 25 b.p. – First cut since 2020, signaling monetary policy easing

- Bank of Canada also cut rates – Synchronized decision supported North American markets

- Inflation continues to decline – Provides room for further rate cuts

Corporate News

- AppLovin entered S&P 500 – Important milestone for the company

- Celestica exceeded expectations – Strong quarterly report

- AI sector continues growth – Investors optimistic about the future

📝 Lessons of the Month

What Worked Well ✅

- Focus on technology and semiconductor sectors. AI growth will continue, and accordingly, investments in this direction show strong results

- Diversification between TFSA and RRSP – Different strategies in different accounts provide flexibility

What Can Be Improved 📚

- Unfortunately, couldn’t add anything to the portfolio over the summer. Had difficult months with quite a few unexpected expenses. I don’t like this, but I’m working on it

- If I could change something from the beginning, I would probably reduce the number of different stocks to increase stakes in the best positions

Key Takeaways 💡

- Everything is going very well so far, but it can’t always be this way. Expecting a correction. Hope it won’t be too painful

- Importance of patience – Best positions (CLS, APP) have been held for several months

- Not all investments are winners – There are underperformers too, which is normal

🔮 Plans for Next Month

What I’m Watching 👀

- CoreWeave – Was tracking this company, wanted to invest but didn’t have available funds. When I wanted to buy these shares, the price was $90, and today it crossed $140. Would have been +55%. Missed opportunity, but a lesson for the future

- Mid-October earnings reports: TSM, RF – Will closely monitor the results

Strategic Goals 🎯

- Analyze portfolio and consider rebalancing – Some positions have grown too much

- AI development requires significant energy consumption growth – Need to look for companies in the energy sector that could benefit from this

- Increase regular investments – Return to monthly portfolio contributions

💡 Dividends and Passive Income

Dividends received in September: CAD $6.95

I have several dividend-paying companies, but the dividends are so small that it doesn’t even make sense to write about them in detail. What I mean is that my dividend portfolio is very small. This isn’t the main strategy at this stage – currently focusing on capital growth.

Dividend positions in portfolio:

- RF (Regions Financial Corp)

- JEPQ (JPMorgan Nasdaq Equity Premium Income ETF)

- UNH (UnitedHealth Group)

📈 Year-to-Date Statistics

- Total YTD Return: +41.43%

- Best Month: September 2025 (+11.6%)

- Number of trades in September: 1 (DFLI purchase)

- Total number of positions: 28 stocks/ETFs

- Best investment: CLS (+273%)

❓ Discussion Questions

Interested to hear your thoughts:

- How do you assess the current market situation? Do you think rate cuts will lead to further growth?

- Which sectors do you consider most promising in the context of AI development and energy changes?

- Do you have any interesting investment ideas? Perhaps something I missed?

Write in the comments, I’ll be happy to discuss! 💬

📊 Summary

September 2025 was the most successful month since portfolio creation. Interest rate cuts, strong corporate results, and proper sector focus delivered +11.6% returns. The portfolio continues to outperform the S&P 500, which is particularly pleasing.

New challenges and opportunities lie ahead. I continue to learn, analyze, and develop my investment strategy.

Disclaimer: This post is not investment advice. All investments carry risks, and past performance does not guarantee future results. Always conduct your own research or consult with a financial advisor before making investment decisions.