Investment Report for January 2026: Radical Portfolio Rotation

Reading time: ~10 minutes

📈 Key Performance Metrics (January 2026)

Total Portfolio Return: +2.08% (for the month)

Total Portfolio Value: $19,936.33 CAD

Monthly Change: +$406.65 CAD

YTD Return 2026: +2.08%

Total Invested Since Start: $13,555 CAD

Realized Profit: +$6,381.33 CAD

ROI Since Start: +47.09%

Quick Overview

January 2026 became a month of radical changes in my portfolio. After December’s correction (-4.7%), I made the most important decision since I started investing: sold 6 positions in one day and invested freed capital into 4 completely new companies with powerful growth potential.

The month ended with +2.08% (+$406.65 CAD) return, but the most important thing isn’t the numbers—it’s the qualitative transformation of the portfolio. I got rid of “average performers” and companies without clear growth drivers, concentrating on future leaders.

Key Events of the Month:

- ❌ Sold 6 positions – complete portfolio rotation (DOL, JEPQ, VFV, RF, CSCO, BDT)

- ✅ Bought 4 new companies – NVDA, CRVW, S (SentinelOne), VG (Venture Global)

- 📉 Market dropped at month end – correction after 2-year rally

- 🏆 Celestica remains champion – +316.81% (despite drop from +342%)

- 🚀 AMD reached new high – +138.88%

- 💰 Dividends – received $24.67 CAD

🔄 Main Event: Radical Portfolio Rotation

January will be remembered as the month of the most decisive actions in my entire investing journey. In one day, I sold 6 positions and completely reformatted my portfolio strategy.

❌ What I Sold and Why

After deep analysis of December results, I realized: quantity of positions doesn’t equal portfolio quality. 28-29 companies is too many, especially when half show mediocre results or stagnate.

Decision: Sell companies that:

- Don’t have clear growth drivers

- Show slow growth (<15% annually)

- Belong to sectors with limited potential

1. DOL (Dollarama) – Sold at $205.79 CAD

Originally bought at: $157.70 CAD

Profit: +30.49%

Reason for sale:

I may be wrong, but I see no significant further growth ahead. Additionally, the stock looked too expensive. I held these shares for less than a year and decided to lock in good profit, as well as free up money for more attractive companies, in my view. Time will tell if I was right. Because if the next report is weak and considering the current stock price, they could drop sharply.

Conclusion: Good company, but I don’t believe in further rapid growth.

2. JEPQ (JPMorgan Equity Premium Income ETF) – Sold at $58.05 USD

Originally bought at: $58.32 USD

Result: -0.46% (minimal loss)

Reason for sale:

JEPQ is an ETF focused on dividend income, not capital growth. When I bought it, I thought passive income was good. It’s actually good when you have significant capital.

I’ll start collecting dividends in 10-15 years when I’m preparing for retirement. Right now, every dollar should work for maximum growth.

Conclusion: Priorities changed—from income to growth.

3. VFV (Vanguard S&P 500 Index ETF) – Sold at $166.78 CAD

Originally bought at: $154.17 CAD

Profit: +8.18%

Reason for sale:

VFV is passive S&P 500 investing. Safe, stable, gives ~10% per year. Perfect for those who don’t want to actively manage their portfolio.

But I don’t want to just match the market—I want to beat it. My 2025 result (+44.21%) showed: active investing in quality companies works better than indices.

Conclusion: Indices are for passive investors. I want to actively pick winners.

4. RF (Regions Financial) – Sold at $27.53 USD

Originally bought at: $24.38 USD

Profit: +12.92%

Reason for sale:

Regions Financial is a regional bank. Pays dividends, stable business. But the banking sector is now under enormous pressure:

- High Fed interest rates

- Commercial real estate problems

- Competition from fintech companies

- Slow growth

RF’s growth for the year – only +12.92%. Better than a savings account, but much worse than tech companies.

Conclusion: Actually, considering dividends, RF showed excellent results, but focusing on dividends makes no sense with my small capital, in my opinion.

5. CSCO (Cisco Systems) – Sold at $76.02 USD

Originally bought at: $65.14 USD

Profit: +16.71%

Reason for sale:

Cisco is “old tech”. Large, stable, predictable networking equipment company. But it has no wow factor.

When you look at Cisco versus NVIDIA/AMD/CoreWeave—the difference is obvious:

- Cisco grows 5-10% per year

- NVIDIA grows 50-100%+ per year

Cisco doesn’t participate in the AI revolution, has no breakthrough products, shows no exponential growth.

Conclusion: To be honest, I expected more from the company.

6. BDT (Bird Construction) – Sold at $29.17 CAD

Originally bought at: $22.08 CAD

Profit: +32.11%

Reason for sale:

Similar situation to Dollarama. I got good profit but don’t see prospects for further growth. I may be wrong.

Conclusion: Good company, but prospects are unclear.

📊 Sales Summary

| Ticker | Sale Price | Purchase Price | Result |

|---|---|---|---|

| DOL | $205.79 CAD | $157.70 CAD | +30.49% ✅ |

| JEPQ | $58.05 USD | $58.32 USD | -0.46% ❌ |

| VFV | $166.78 CAD | $154.17 CAD | +8.18% ✅ |

| RF | $27.53 USD | $24.38 USD | +12.92% ✅ |

| CSCO | $76.02 USD | $65.14 USD | +16.71% ✅ |

| BDT | $29.17 CAD | $22.08 CAD | +32.11% ✅ |

Result: 5 out of 6 positions sold with profit

Average return: ~+16.6%

💡 What I Learned from This Rotation

1. Not all profitable positions are worth keeping

Some were sold due to “unclear” future prospects, and some due to small number of shares. Decided to reduce number of stocks but increase their share.

2. Concentration > Diversification

28 positions is too many. Impossible to track all companies, read all reports, understand all businesses. Better to have 15-20 quality companies you deeply understand than 30 random ones.

3. Strategy is more important than tactics

Selling these 6 positions wasn’t an emotional decision. It’s strategic reorientation from:

- Dividends → to capital growth

- Reducing number of stocks and increasing their volume

✨ New Horizons: 4 Companies of the Future

I invested freed capital into 4 companies representing megatrends of the next decade.

These aren’t impulsive purchases. These are companies I’ve been watching for months, waiting for the right entry point. January’s market dip created the perfect opportunity.

1. 🤖 NVDA (NVIDIA) – 6 shares at $189.80 USD

Total investment: $1,138.80 USD

Current value: $1,141.50 USD

Current return: +0.24%

Portfolio share: ~5.7%

Investment Thesis

NVIDIA isn’t just a “graphics card maker.” It’s the absolute monopolist in AI computing. Their GPUs power:

- ChatGPT and all large language models

- Autonomous vehicles (Tesla, Waymo)

- Scientific research and simulations

- Data centers of Microsoft, Google, Amazon

- Robotics

Why now?

NVIDIA stock fell from peak $207+ to $189 due to:

- General market correction

- Profit-taking after 2-year rally

- Short-term concerns about AI investment ROI

But fundamentally nothing changed:

- Demand for H100/H200 GPUs remains enormous

- Queue for new Blackwell GPUs—months of waiting

- Every AI company needs NVIDIA chips

Strategy:

Long-term hold 3-5 years. NVIDIA is the company powering the AI revolution, and AI isn’t hype—it’s fundamental economic change.

Risks:

- Competition (AMD, Intel trying to catch up)

- Dependency on data center upgrade cycles

- Possible export restrictions to China

- High valuation (P/E ~60-70)

2. 🌊 CRVW (CoreWeave) – 9 shares at $80.36 USD

Total investment: $723.24 USD

Current value: $833.20 USD

Current return: +15.20% 🚀

Portfolio share: ~4.2%

Investment Thesis

CoreWeave is “shovels during the AI gold rush”. When everyone was running to find gold, those who made the most money sold shovels and pickaxes. Was choosing between CoreWeave, Nebius, and IREN.

CoreWeave doesn’t create AI models. They provide GPU infrastructure to companies creating AI. Their clients:

- OpenAI

- Stability AI

- Character.AI

- Dozens of other AI startups

Why now?

Demand for AI computing power is growing faster than it can be built. CoreWeave:

- Aggressively expanding capacity

- Signing long-term contracts

- Has exclusive deals with GPU suppliers

Strategy:

Medium-term hold 2-3 years. If company executes expansion plans, 3-5x potential is real.

Risks:

- Young public company (IPO 2024)

- Competition from AWS, Azure, Google Cloud

- Capital-intensive business model

- Dependency on AI investment cycle

3. 🛡️ S (SentinelOne) – 37 shares at $14.51 USD

Total investment: $536.87 USD

Current value: $517.17 USD

Current return: -3.67%

Portfolio share: ~2.6%

Investment Thesis

Cybersecurity isn’t optional expense—it’s critical necessity. Every company, every government, every organization faces cyber threats daily.

SentinelOne uses AI to detect and block threats in real-time. Unlike traditional antivirus working on signatures, SentinelOne:

- Analyzes program behavior

- Detects zero-day attacks

- Automatically responds to threats

Why now?

Stock fell from $25+ to $14 due to:

- General cybersecurity sector correction

- Company still unprofitable

- Competition with CrowdStrike (market leader)

But 30%+ annual revenue growth shows: product works, customers pay, company scales.

Strategy:

Long-term bet for 3-5 years. Cybersecurity is a sector that will never disappear and will only grow.

Risks:

- Company still unprofitable

- Fierce competition (CrowdStrike, Palo Alto Networks)

- High customer acquisition cost

- Dependency on corporate IT budgets

4. ⚡ VG (Venture Global) – 69 shares at $7.14 USD

Total investment: $492.66 USD

Current value: $669.99 USD

Current return: +35.99% 🚀🚀

Portfolio share: ~3.4%

Investment Thesis

Venture Global is one of the largest LNG producers in the US. Not the sexiest business, but it has a powerful long-term thesis:

Europe is abandoning Russian gas forever. This means:

- Long-term contracts for 10-20 years

- Stable cash flow

- Predictable profits

Why now?

Venture Global is building new LNG terminals on Louisiana coast. When they operate at full capacity (2026-2027), company revenue and profits will double.

Strategy:

Medium-term hold 3-5 years. Not a tech company with 10x potential, but stable growth with 2-3x potential is quite realistic. Additionally, gas demand will only grow as we move toward electricity deficit, consumption of which should increase significantly.

Risks:

- Natural gas price volatility

- Regulatory delays in terminal construction

- Competition from other LNG producers

- Geopolitical risks (though currently working IN favor of company)

🎯 Why These 4 Companies?

They represent 4 megatrends of the next decade:

1. AI Revolution (NVDA, CRVW)

Artificial intelligence isn’t hype. It’s fundamental technological change, like the internet in the 1990s or mobile phones in the 2000s.

Every company is integrating AI into their products. This means:

- Huge demand for GPUs (NVIDIA)

- Huge demand for computing power (CoreWeave)

2. Cybersecurity (SentinelOne)

The more we digitize, the more attack surface. Cybersecurity is constantly growing market without ceiling.

3. Energy Security (Venture Global)

The unstable situation in the world showed: energy independence is national security. Europe will never return to Russian gas. This is structural change for decades.

4. Diversification

4 different sectors = lower risk. If AI hype fades, cybersecurity and energy will continue growing.

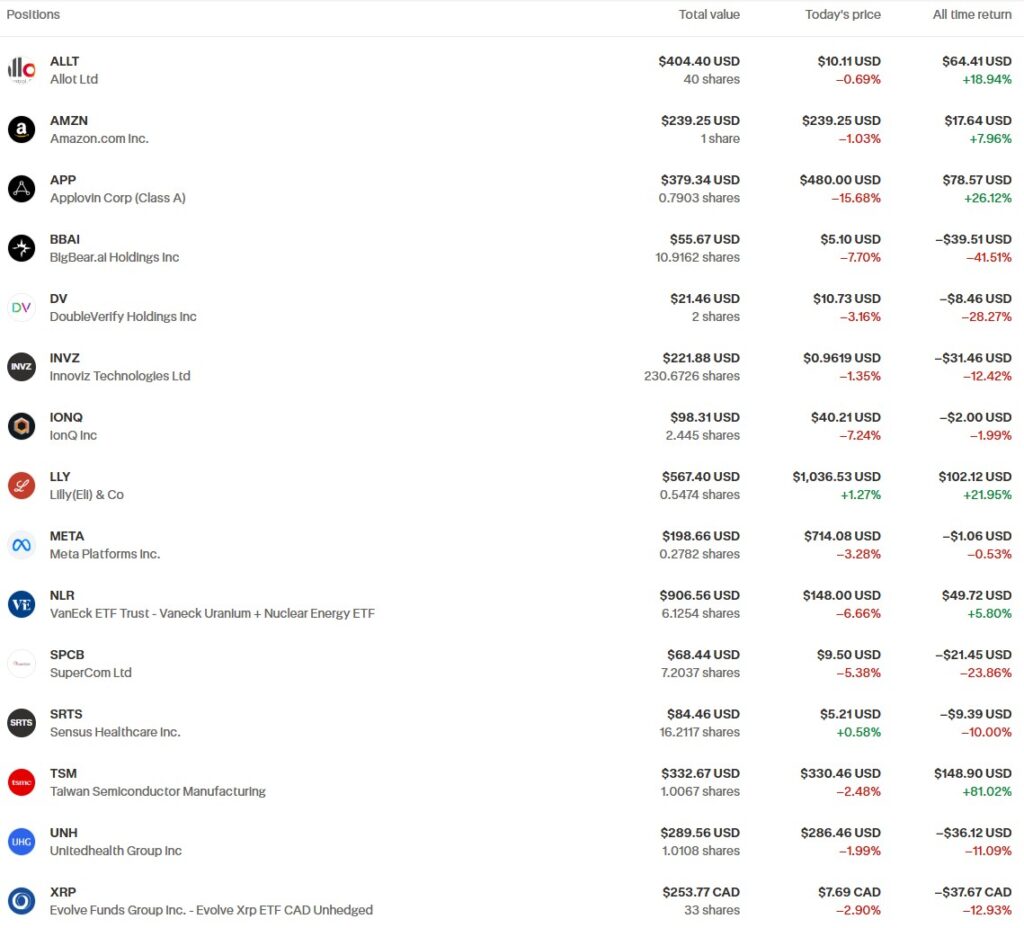

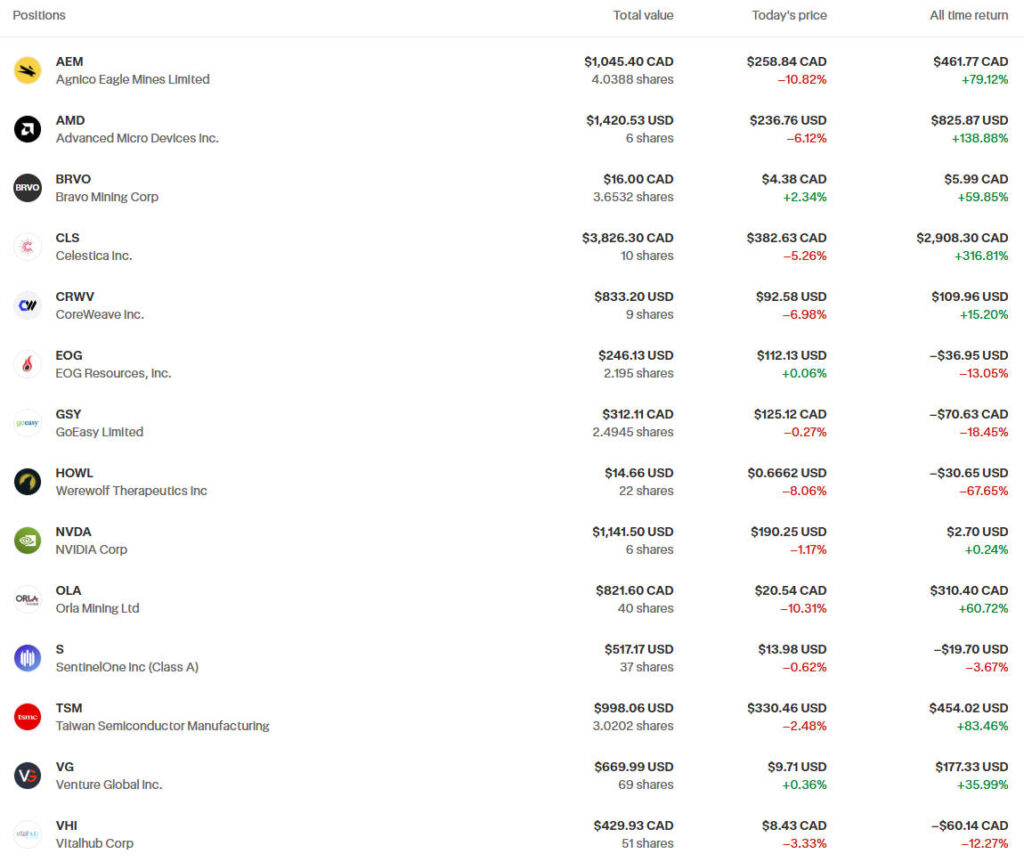

🏆 Top Positions of the Month

🟢 January’s Best Performers

1. Celestica Inc (CLS) – +316.81% 🏆

End of December: $4,060.10 CAD (+342.28%)

End of January: $3,826.30 CAD (+316.81%)

Monthly change: -5.76%

Portfolio share: 18.89% (RRSP)

Comment:

Despite correction from +342% to +316%, Celestica remains absolute portfolio champion. Company continues winning from AI boom:

- Manufactures networking equipment for data centers

- Clients: Microsoft, Google, Meta

- Revenue growth 20%+ annually

-5.76% monthly drop is technical correction after powerful growth. Fundamentally nothing changed.

What’s next:

Holding for now. Taking a risk, want to wait for return to peak and then sell.

2. AMD (Advanced Micro Devices) – +138.88% 🥈

End of December: $1,284.08 USD (+115.93%)

End of January: $1,420.53 USD (+138.88%)

Monthly change: +10.63%

Portfolio share: 7.02% (RRSP)

Comment:

AMD exceeded +138% for first time! This is new historic high for this position. Company continues taking market share from Intel and competing with NVIDIA in AI chips.

Recent news:

- AMD MI300X GPUs showing strong results

- Microsoft, Meta using AMD to diversify from NVIDIA

- 80%+ growth in data center segment

What’s next:

Holding long-term. Not thinking about selling yet. Hope for significant growth in next 3-5 years.

3. TSM (Taiwan Semiconductor) – +83.46% (RRSP) / +81.02% (TFSA) 🥉

RRSP: $998.06 USD (+83.46%)

TFSA: $332.67 USD (+81.02%)

Portfolio share: 6.56% (total)

Comment:

TSMC is chip manufacturer for everyone. Apple, NVIDIA, AMD, Qualcomm—all depend on TSMC. Company with:

- Technological advantage (3nm, 2nm processes)

- Unique competencies

- Irreplaceable in supply chain

What’s next:

One of highest quality portfolio positions. Holding long-term, possible additions on dips.

4. VG (Venture Global) – +35.99% 🌟

Monthly result: +35.99%

Portfolio share: 3.31% (RRSP)

Comment:

Best new purchase of January! +36% growth in first month—excellent start. Company announced signing new long-term contracts with European buyers.

5. OLA (Orla Mining) – +60.72% 💎

Current value: $821.60 CAD

Return: +60.72%

Comment:

Gold mining company continues growing with gold price. Gold trading near historic highs due to geopolitical tension and inflation expectations.

🔴 January’s Biggest Losers

1. HOWL (Werewolf Therapeutics) – -67.65% 💔

Current value: $14.66 USD

Total return: -67.65%

Portfolio share: 0.07% (TFSA)

Comment:

Worst portfolio investment. Biotech company showed no positive clinical trial results. Stock dropped -67%.

What’s next:

Holding. Position so small (0.07% of portfolio) that selling makes no sense. If company announces positive research progress—may recover. If not—will lose another $15.

2. BBAI (BigBear.ai) – -41.51%

Current value: $55.67 USD

Total return: -41.51%

Comment:

AI hype didn’t help this company. Despite trendy “AI” in name, business shows no growth. Though company has potential to recover. We’ll see.

3. VHI (Vitalhub) – -12.27%

Monthly change: -12.27%

Current value: $429.93 CAD

Comment:

Young tech company in medical software space. -12% monthly volatility is normal for small companies.

🌍 What Influenced the Market in January

Macroeconomic Factors

1. Trade wars intensified

US and China exchanging tariffs:

- 25% tariffs on Chinese goods

- China responds with tariffs on American goods

- Tech companies under pressure from possible restrictions

2. Inflation remains high

Fed keeping rates at 5.25-5.50%. High rates = pressure on tech stocks valued on future cash flows.

3. AI hype vs AI reality

Investors starting to ask questions:

- When will AI investments start paying off?

- Is AI hype justified?

- Which companies actually earn from AI?

This creates volatility in AI sector.

4. Geopolitical tension

- War in Ukraine continues

- Middle East conflict

- Taiwan question

- This supports gold and energy prices

January Sentiment

What happened:

Market started January strong (first 2-3 weeks were positive), but dropped at month end. This is typical profit-taking pattern after:

- 2-year bull market (2023-2024)

- Record S&P 500 highs

- Stretched valuations in tech sector

Why it matters:

-5-10% correction after 2 years of growth is absolutely normal. This isn’t crash beginning, but healthy correction. Such volatility creates opportunities for:

- Entry into quality companies at lower prices

- Portfolio rebalancing

- Buying leaders on dips

Corporate News

NVIDIA:

- Introduced new Blackwell GPUs

- Demand remains enormous

- Queue for new chips—months of waiting

CoreWeave:

- Announced new contracts with AI companies

- 50% capacity expansion in 2026

SentinelOne:

- 30%+ revenue growth

- Added major enterprise clients

Venture Global:

- Progress in building new LNG terminals

- Signing long-term contracts with EU

📝 January Lessons

What Worked Excellently ✅

1. Decisiveness in portfolio rotation

Selling 6 positions in one day was psychologically difficult. Especially DOL (+30%) and BDT (+32%) that gave profit.

But I realized: profit ≠ success. If company gives +30% per year while others give +100%+, you’re losing opportunities.

Lesson: Don’t fear selling profitable positions if better opportunities exist.

2. Focus on megatrends

New 4 positions aren’t random choices. These are companies at intersection of most powerful trends:

- AI revolution

- Cybersecurity

- Energy security

These trends will last years, possibly decades.

Lesson: Invest in structural changes, not short-term hypes.

3. Patience with winners

CLS (-5.76% for month), but stays at +316.81%.

AMD (+10.63% for month), reached +138.88%.

TSM holding at +83%.

I didn’t sell during January correction. This was right decision.

Lesson: Winners keep winning. Hold winners, sell losers.

4. Emotional stability

January’s end-of-month drop didn’t cause panic. I understand: market doesn’t grow in straight line. -5-10% corrections are normal.

This isn’t first drop (spring 2025 was worse), and certainly not last.

Lesson: Emotional stability is competitive advantage in investing.

What Can Be Improved 📚

Too many weak positions

HOWL (-67.65%), BBAI (-41.51%), EOG (-13.05%), GSY (-18.45%)—portfolio ballast.

These 4 positions tie up ~$900 USD capital that could work more productively in other stocks.

Plan: Holding for now, monitoring news.

2. NVDA – could have entered earlier

Bought at $189.80, but stock was $140-150 in November-December. If entered earlier, could have earned additional 20-30%. At the time I wanted to buy Nvidia, shares were about $135, but didn’t have free capital.

Lesson: If thesis is strong—don’t wait for “perfect” price. Enter in portions.

3. Need clear profit-taking rules

CLS (+316%), AMD (+138%)—fantastic results. But need a plan when to lock partial profit.

Key Takeaways 💡

1. Portfolio rotation is normal

Don’t fear selling positions. Capital is limited resource, and it should work most efficiently.

2. Concentration > Diversification

28 positions → reducing to 20-22. Better to have 20 quality companies you deeply understand than 30 random ones.

4. Corrections are opportunities, not threats

Dips aren’t reason to panic. Chance to buy quality at lower price.

5. Emotions are investor’s main enemy

Market will fall. Sometimes -10%, sometimes -20%. If you’re not psychologically ready—better not invest in stocks.

🔮 February 2026 Plans

Critical Decisions

1. Continue portfolio cleanup

Planning to get rid of some positions when opportunity arises.

2. Add/free capital for short-term positions

Sometimes I see opportunities for short-term entry but don’t have free capital. Thinking to free up funds or add to account (when possible) for such purposes.

What I’ll Watch 👀

AI Sector

Q4 2025/Q1 2026 Reports:

- NVIDIA – how strong is Blackwell GPU demand?

- AMD – continuing to take market share?

- CoreWeave – growth rates, new contracts

General market sentiment:

- Are companies continuing to invest in AI?

- When will AI investments start paying off?

- Which use cases show real value?

Cybersecurity

SentinelOne Q4 2025 earnings:

- Revenue growth rate (target 30%+)

- Progress to profitability

- Customer base expansion

General trends:

- Number of cyberattacks (growing = demand growing)

- Corporate IT security budgets

Energy

Venture Global:

- LNG terminal construction progress

- New long-term contracts with Europe

- Natural gas prices in Europe

Macroeconomics

Fed:

- When will start cutting rates? (current forecast: mid-2026)

- How’s inflation? (need <2.5% for rate cuts)

Trade wars:

- US vs China – escalation or de-escalation?

- Impact on tech companies

📈 Statistics Since Start of Investing

Overall Metrics

Start of investing: February 2025

Total invested: $13,555 CAD

Current portfolio value: $19,936.33 CAD

Profit: +$6,381.33 CAD

ROI: +47.09%

Period: 12 months

Best Months

- September 2025: +11.6%

- October 2025: ~+8%

- November 2025: ~+4%

- January 2026: +2.08%

Worst Months

- December 2025: -4.7%

- May 2025: ~-3%

Best Investments All-Time

- CLS (Celestica): +316.81% 🏆

- AMD: +138.88% 🥈

- TSM (RRSP): +83.46% 🥉

- TSM (TFSA): +81.02%

- AEM (Agnico Eagle): +79.12%

- OLA (Orla Mining): +60.72%

- BRVO (Bravo Mining): +59.85%

- VG (Venture Global): +35.99% ⭐ NEW

- APP (AppLovin): +26.12%

Worst Investments All-Time

- HOWL (Werewolf): -67.65% 💔

- BBAI (BigBear.ai): -41.51%

- SPCB (SuperCom): -23.86%

- DV (DoubleVerify): -28.27%

- GSY (GoEasy): -18.45%

- EOG (EOG Resources): -13.05%

- XRP (Crypto ETF): -12.93%

- INVZ (Innoviz): -12.42%

Win Rate Statistics

Number of positions: 28

Positions in profit: 17

Positions in loss: 11

Win rate: ~60.7%

Top-5 positions provide: ~65% of total profit

Bottom-5 positions take: ~15% of potential profit

Number of Trades for Year

Total trades: ~15-18

Purchases: ~12

Sales: ~6-8

January 2026:

- Sales: 6

- Purchases: 4

Sector Allocation (updated after January)

💻 Technology & AI: ~52% (↑ from 47%)

- NVDA, AMD, TSM, CRVW, APP, META, AMZN, CLS

💊 Healthcare: ~12% (↓ from 14%)

- LLY, UNH, HOWL, SRTS, VHI

⛏️ Mining (gold, copper): ~10%

- AEM, OLA, BRVO

🛡️ Cybersecurity: ~3% (NEW!)

- S (SentinelOne), ALLT

⚡ Energy: ~6%

- VG, NLR, EOG

💰 Finance & other: ~5%

- GSY, XRP

📊 Weak speculations: ~12%

- BBAI, INVZ, IONQ, DV, SPCB and others

Conclusion: Portfolio became significantly more focused on technology and AI. This aligns with my beliefs about the future.

❓ Discussion Questions

Interested to hear your thoughts:

- Did I do right selling 6 profitable positions (DOL +30%, BDT +32%, CSCO +16%) for new opportunities?

- NVIDIA at $189 – good entry point or should have waited for $170-180?

- CoreWeave – worth investing in “AI shovels” or better to buy NVIDIA/AMD directly?

- SentinelOne – company unprofitable but growing 30%+ annually. Worth holding such growth stocks in portfolio?

- Venture Global – is there future for LNG companies in renewable energy era?

- Weak positions (HOWL -67%, BBAI -41%) – sell at bottom or wait for recovery?

Write in comments, happy to discuss! 💬

📊 January Conclusions

January 2026 became month of portfolio transformation. Result +2.08% (+$406.65) isn’t most important. Main thing is qualitative changes:

What I Did Right ✅

- Decisively executed rotation – sold 6 positions without hesitation

- Focused on megatrends – AI, cybersecurity, energy security

- Held winners – CLS, AMD, TSM despite correction

- Maintained emotional stability – didn’t panic during January drop

What I’ll Improve in February 📚

- Will monitor opportunity to get rid of weak positions

- Hope to find opportunity to add to account

January’s Main Lesson 💡

Capital is limited resource. Every dollar sitting in weak company isn’t working in strong one.

Selling profitable but slow position (+30% per year) for fast-growing one (+100%+ potential) is right decision, even if psychologically difficult.

Thanks to everyone reading my reports! See you in February with new results! 📈

Disclaimer

This post is not investment advice. All investments carry risks, and past performance doesn’t guarantee future results. Always conduct your own research or consult with financial advisor before making investment decisions.

I’m sharing my personal experience solely for educational purposes. You bear full responsibility for your own investment decisions.

Subscribe for monthly investment reports and insights!